A Data-Driven Review of Real Estate Funds Launched Since 2014

Executive Summary

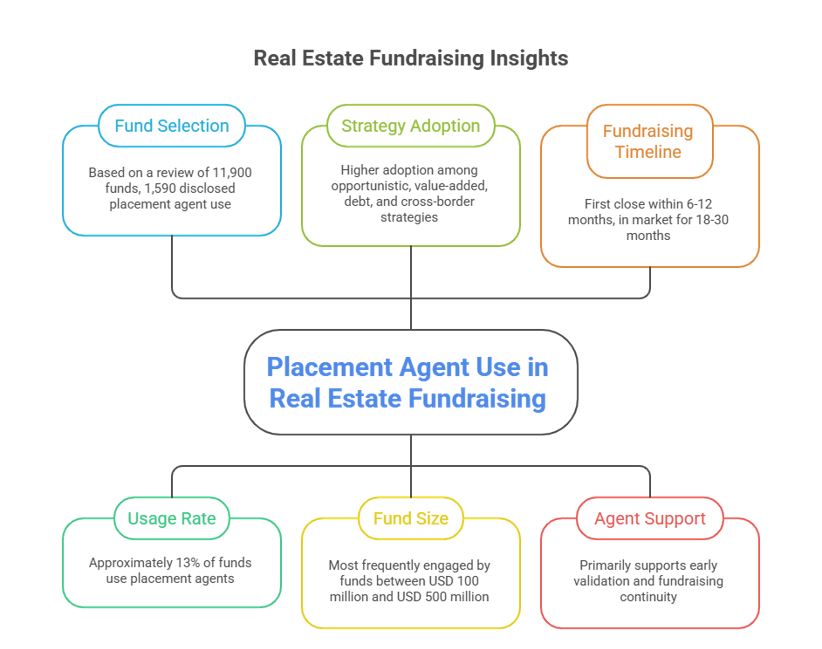

- Based on a proprietary review of 11,900 real estate funds launched since 2014, this study isolates 1,590 funds that explicitly disclosed the use of Placement Agents, providing a rare empirical lens into how institutional real estate capital is raised in practice.

- Placement agent usage within real estate remains selective rather than universal, representing approximately 13% of the total fund universe, with materially higher adoption among opportunistic, value-added, debt, and cross-border strategies.

- The data shows that placement agents are most frequently engaged by funds in the US$ 100 million to US$500 million range, where institutional LP requirements intensify but global investor coverage remains incomplete.

- Where disclosed, funds utilizing placement agents typically reached a first close within 6 to 7 months and remained in market for 18 to 26 months, suggesting that agents primarily support early validation and fundraising continuity, rather than accelerating final closes.

- Repeat engagement of the same placement agents across multiple fund vintages highlights a relationship-driven ecosystem, where trusted agents function as long-term capital partners rather than transactional intermediaries.

1. Introduction and Study Objective 🏢

I recently conducted a comprehensive review of my exclusive database of real estate funds launched globally since 2014. The purpose of this research is to shed light on the use of placement agents in institutional real estate fundraising and to better understand the circumstances under which fund managers engage third-party capital raising specialists.

Placement agents occupy a critical position within the institutional real estate fundraising ecosystem. As limited partner expectations have increased, regulatory scrutiny has intensified, and capital has become more globally mobile yet increasingly selective, the fundraising process has evolved into a highly structured and competitive exercise. In this environment, placement agents are frequently engaged to provide strategic guidance, investor access, and execution support.

The database underpinning this study contains approximately 11,900 real estate funds launched since 2014. Of these, 1,590 funds explicitly disclosed the use of placement agents during their fundraising process. This subset forms the analytical foundation of the study.

As with most private markets datasets, disclosure is uneven. Several fields are either incomplete or marked as “not disclosed,” particularly those related to interim fundraising milestones, timelines, and internal economics. Rather than treating this as a constraint, the methodology intentionally focuses on funds that have affirmatively disclosed placement agent involvement. This allows for a more reliable examination of observable trends, habits, and structural patterns among managers who elect to use placement agents.

The objective of this research is therefore not to generalize across the entire real estate fund universe, but to extract insights from the disclosed cohort in order to understand:

- Which real estate strategies most frequently employ placement agents

- How placement agent usage varies by geography and fund profile

- What fundraising behaviors and timelines are commonly associated with agent-led mandates

2. Placement Agents in the Current Market 🌍

In the current institutional fundraising environment, the use of placement agents is widely regarded as a strategic decision rather than a signal of limited internal capability. Many established managers with longstanding LP relationships continue to retain placement agents, particularly for large-scale, multi-jurisdictional, or strategically complex fundraises.

Placement agents typically function as:

- Strategic advisors on fund positioning and structure

- Gatekeepers to institutional investor networks

- Project managers overseeing global fundraising execution

- Extensions of a general partner’s investor relations team

Their involvement is especially prevalent in first-time funds, strategy transitions, geographic expansion, or mandates involving opportunistic, distressed, or real estate debt strategies, where investor diligence and education requirements are more intensive.

3. Market Prevalence of Placement Agents 📊

While placement agents are not universally used, industry data from 2024 to 2025 indicates consistent and meaningful adoption across private markets, with notable variation by asset class and fund characteristics.

Estimated Usage by Asset Class

| Asset Class | Estimated Percentage of Funds Using Placement Agents |

| Global Real Estate | Approximately 12% to 15% |

| Private Equity | Approximately 20% to 25% |

| Mega-Funds (Value-Weighted) | Up to 75% |

Within real estate specifically, placement agent usage is materially higher among:

- First-time or emerging managers

- Funds targeting pensions, insurance companies, and sovereign wealth funds

- Managers raising capital outside their primary domicile or investor base

In private equity, placement agents are frequently retained not merely for investor introductions, but for full lifecycle fundraising management across multiple regions.

4. Typical Placement Agent Fee Structures 💼

Placement agent compensation structures are well established across institutional mandates and generally consist of two components: success fees and retainer fees.

4.1 Success Fees

Success fees are paid only on capital successfully committed by investors introduced or actively managed by the placement agent.

Typical Ranges

| Fund Type | Common Success Fee Range |

| Standard Institutional Mandates | 2.0% to 2.5% |

| Core and Core-Plus Real Estate | 1.5% to 2.0% |

| Emerging Managers or Niche Strategies | 3.0% to 5.0% |

Note: While success fees of up to 6%–8% are occasionally cited in market discussions, these typically relate to retail distribution, feeder fund structures, or highly distressed and non-institutional mandates. For institutional real estate funds targeting pensions, sovereigns, insurers, and large family offices, the prevailing success fee range remains materially lower, generally between 1.5% and 2.5%, with higher fees reserved for emerging managers or specialized strategies.

In real estate, success fees often align with approximately one year of management fees for core and core-plus strategies. Fees are rarely paid upfront in full and are typically structured over two to three years following an investor’s closing date, allowing general partners to manage early-stage cash flow more effectively.

4.2 Retainer Fees

Retainer fees are intended to cover fixed pre-marketing and execution costs incurred by the placement agent. These typically include due diligence preparation, data room development, positioning advice, and investor targeting strategy.

Typical Retainer Levels

| Mandate Type | Typical Retainer Range |

| Basic Institutional Mandate | USD 50,000 to 100,000 |

| Full-Service Mandate | USD 150,000 to 300,000+ |

In most institutional agreements, retainers are fully credited against the final success fee. For example, if a placement agent earns a USD 1 million success fee and has already received a USD 200,000 retainer, the remaining payment would be USD 800,000.

5. Key Industry Terms and Commercial Mechanics 📘

| Term | Typical Range | Description |

| Tail Period | 12 to 24 months | Protects the agent if an investor introduced during the mandate commits after termination |

| GP Commitment Offset | Not applicable | Success fees are almost never charged on the GP’s own capital commitment |

| Capped Expenses | USD 25,000 to 75,000 | Out-of-pocket expenses billed separately but capped contractually |

These terms are standard across institutional placement mandates and materially influence overall fundraising economics.

6. Relevance to the Real Estate Dataset 🔍

Understanding these industry norms is essential for interpreting the findings derived from the disclosed placement agent dataset. The decision to engage a placement agent frequently signals:

- A deliberate institutional fundraising strategy

- Targeting of larger and more sophisticated limited partners

- Increased complexity in fund structure, geography, or investment strategy

The remainder of this research builds on this foundation by analyzing the 1,590 disclosed real estate funds to identify structural patterns across strategy, geography, fund size, fundraising duration, and placement agent selection.

This approach allows for a grounded, data-supported view of how placement agents are actually used in real estate fundraising, rather than how they are theoretically positioned.

7. Empirical Findings From the Placement Agent–Disclosed Cohort (1,590 Funds) 📈

This section summarizes the observable fundraising characteristics of the 1,590 real estate funds within the database that explicitly disclosed the use of one or more placement agents. These findings are derived exclusively from disclosed data fields and therefore reflect actual reported behavior, rather than inferred or estimated activity across the broader universe.

It is important to note that not all funds disclosed every fundraising milestone. As such, the analysis emphasizes directional trends, clustering behavior, and recurring patterns, rather than absolute averages across all variables.

7.1 Strategy-Level Distribution of Placement Agent Usage 🧭

Among the 1,590 funds reviewed, placement agent usage is not evenly distributed across real estate strategies. Instead, it is heavily concentrated in strategies that require deeper institutional underwriting, higher investor education, or more complex capital structuring.

Dominant Strategies Observed

| Strategy Category | Observed Trend |

| Opportunistic | Highest concentration of PA usage |

| Value-Added | Strong and consistent PA adoption |

| Real Estate Debt | Material usage, particularly post-2020 |

| Core / Core-Plus | Lower relative usage, but still meaningful |

| Distressed / Special Situations | High likelihood of PA involvement |

Interpretation:

Placement agents are most frequently engaged where:

- The return profile requires extensive explanation

- Deal execution is cyclical or counter-cyclical

- Capital deployment pacing and risk mitigation are central LP concerns

Core and core-plus strategies show lower proportional usage, reflecting the fact that many established managers in these categories already maintain long-standing institutional LP relationships.

7.2 Geographic Patterns in Placement Agent Engagement 🌍

The disclosed dataset demonstrates clear regional clustering in placement agent usage.

Primary Geographic Focus of PA-Backed Funds

| Region | Observed Characteristics |

| North America | Largest absolute number of PA-backed funds |

| Europe | Strong usage in value-added, debt, and urban regeneration |

| Asia | Concentrated among opportunistic and development strategies |

| Latin America | High PA usage relative to total fund count |

| Middle East | Specialist PA’s with Regional Expertise and dedicated ME offices |

Interpretation:

Placement agents are most commonly retained when:

- Managers raise capital outside their domestic LP base

- Funds target cross-border or emerging market exposure

- Local credibility and institutional translation are required

In Europe and Asia, PA usage is especially prevalent for managers seeking U.S. pension capital, while Latin American real estate funds frequently use agents to access offshore institutional investors.

7.3 Fund Size Characteristics of PA-Backed Real Estate Funds 💰

While disclosed fund sizes span a wide range, the dataset shows clear clustering behavior.

Observed Fund Size Bands (Disclosed)

| Fund Size Range (USD) | Observed Pattern |

| Under $100 million | PA usage primarily among first-time funds |

| $100m – $500m | Highest density of PA-backed mandates |

| $500m – $1bn | Consistent PA usage, often multi-agent |

| $1bn+ | Agents used for global coordination |

Interpretation:

The $100 million to $500 million range represents the structural “sweet spot” for placement agent engagement in real estate. At this level:

- Funds are large enough to justify institutional distribution

- Managers may still lack global coverage

- LP diversification requirements intensify

At the upper end, very large managers frequently retain placement agents not for investor access alone, but for project management across jurisdictions.

7.4 Fundraising Status and Lifecycle Timing ⏳

Analysis of disclosed fundraising status provides insight into when placement agents are typically engaged.

Observed Fundraising Stages

| Status | Frequency Observation |

| Raising / Pre-First Close | Common among PA-backed funds |

| First Close | High incidence of disclosed PA involvement |

| Multiple Closes (Second–Fourth) | PA role often continues |

| Closed / Final Close | PA usage confirmed retrospectively |

Where disclosed, placement agents are most frequently engaged prior to or at first close, reinforcing their role in:

- Anchoring the fund

- Structuring initial LP momentum

- Establishing institutional validation

7.5 Fundraising Timelines (Where Disclosed) 🕰️

Although timeline disclosure is incomplete, the available data is sufficient to identify realistic fundraising expectations for PA-backed real estate funds.

Observed Timing Ranges

| Metric | Typical Observed Range |

| Months to First Close | 6.25 months |

| Total Months in Market | 18 to 26 months |

Interpretation:

Funds using placement agents are not materially faster to final close, but they:

- Achieve earlier institutional validation

- Maintain steadier fundraising momentum

- Are more likely to complete their target raise

This aligns with the role of placement agents as risk reducers, rather than pure accelerators.

7.6 Placement Agent Concentration and Repeat Usage 🤝

A notable feature of the dataset is the repeat appearance of certain placement agents across multiple funds, strategies, and geographies.

Observed Behavioral Patterns

- Large institutional agents appear repeatedly across multi-fund franchises

- Mid-market agents specialize by strategy or region

- Some managers consistently rehire the same agent across vintages

Interpretation:

This reflects a relationship-driven market, where:

- Successful fundraising outcomes reinforce agent selection

- LP trust transfers across fund vintages

- Agents become embedded in GP fundraising strategy

This dynamic materially raises switching costs and favors established placement platforms.

8. Key Takeaways From the 1,590-Fund Dataset 🧠

From the disclosed cohort, several defensible conclusions emerge:

- Placement agent usage in real estate is selective, strategic, and intentional

- Usage increases with fundraising complexity, not GP weakness

- Mid-market and institutional-scale funds rely on agents most heavily

- Cross-border fundraising materially increases PA engagement

- Agents play a critical role in early validation, not just distribution

Taken together, the data confirms that placement agents function as institutional infrastructure providers, particularly in environments where capital is cautious, underwriting is rigorous, and LP attention is scarce.

Key Disclosure

📌 Data Sources and Scope

The information contained in this report is based on known and verifiable data sourced from institutional-grade fundraising and fund intelligence databases, reviewed as of Q1 2025.

To preserve analytical credibility and avoid inference-based assumptions, only real estate funds with disclosed or confirmed use of placement agents have been included in the core analytical sample. Funds with incomplete records, undisclosed fundraising arrangements, or ambiguous third-party involvement were intentionally excluded from trend analysis.

As a result, this report does not attempt to estimate or impute placement agent usage where such information was unavailable. All findings, observations, and conclusions are derived solely from funds with documented placement agent engagement.

This methodology prioritizes data integrity, transparency, and institutional relevance, but it also means that observed trends should be interpreted as indicative of disclosed market behavior rather than exhaustive of all fundraising activity within the real estate fund universe.

January 2026 – ✍️ Written by Andrew Thomas – The Investors Link