Gain direct access to the Who’s Who of Middle East Capital.

This exclusive collection is the definitive source for verified Family Investment Offices across Dubai, Saudi Arabia, and the wider GCC – built for fund managers, developers, and advisors seeking to engage with the region’s most powerful private investors.

Institutional-Grade and Unavailable Anywhere Else

Derived from proprietary, institutional-grade datasets, these databases represent months of research, verification, and curation. They are not publicly available and cannot be acquired through any commercial data vendor. Each record has been carefully screened to ensure relevance, accuracy, and value for professional outreach.

Built for Real Deal Flow

Whether your focus is Real Estate, Private Equity, Infrastructure, or Venture Capital, these databases give you the inside track to trusted, investable relationships that drive cross-border partnerships and long-term capital connections.

🇦🇪 UAE Family Investment Office Database

Direct Access to Dubai’s Elite Investment Families

This exclusive database opens the door to the UAE’s most active Family Investment Offices – the real decision-makers behind private investments, venture capital placements, and high-value real estate acquisitions.

Why It Matters

Dubai and Abu Dhabi have become global centers of private capital. These Family Offices manage multi-billion-dollar portfolios and actively seek opportunities in:

- Real Estate Development & Hospitality

- Private Equity & Venture Funding

- Technology, Fintech, and Energy Transition Projects

What’s Inside

- Verified list of Family Investment Offices headquartered in the UAE – (195)

- Key executives, decision-makers, and contact roles – (430)

- Email contacts (where available) for direct outreach – (200)

- Suitable for fund managers, developers, and advisors seeking genuine capital relationships

Format: Excel (.xlsx)

Delivery: Manually sent within 24 hours after purchase

Payment: PayPal or Credit Card via secure checkout – No Refunds on Database Sales

View The YouTube Video Description Below

🇸🇦 Saudi Arabia Family Investment Office Database

Connect with the Kingdom’s Most Influential Private Investors

Saudi Arabia is home to some of the world’s largest family-controlled investment groups – active across infrastructure, real estate, private equity, and venture capital. This database provides direct access to these powerful networks driving diversification and innovation within Vision 2030.

Why It Matters

As the Kingdom accelerates its transformation under Vision 2030, Saudi Family Investment Offices are aggressively pursuing:

- Real Estate and Tourism Developments

- Technology, Industrial, and Energy Projects

- Private Equity and Direct Investment Opportunities

What’s Inside

- Verified list of Family Investment Offices headquartered in Saudi Arabia – (100)

- Key executives and investment decision-makers – (280)

- Email contacts (where available) for direct outreach (135)

- Ideal for developers, fund managers, and capital advisors targeting strategic Saudi partners

Format: Excel (.xlsx)

Delivery: Manually sent within 24 hours after purchase

Payment: PayPal or Credit Card via secure checkout – No Refunds on Database Sales

View The YouTube Video Description Below

🌍 Middle East Family Investment Office Database (All GCC)

Your Complete Gateway to GCC Private Capital

Gain verified access to the most powerful Family Investment Offices across the Gulf Cooperation Council – including the UAE, Saudi Arabia, Kuwait, Qatar, Bahrain, and Oman. This comprehensive dataset connects you directly to the region’s dominant private investors, wealth managers, and family-controlled investment groups.

Why It Matters

The GCC is one of the fastest-growing sources of private capital globally. These Family Offices are actively diversifying beyond oil and deploying capital into:

- Real Estate, Infrastructure & Hospitality Projects

- Private Equity, Venture Capital & Fund Investments

- Renewable Energy, Fintech & Strategic Technologies

What’s Inside

- 425 Family Investment Offices across the GCC

- 1,025 key decision-makers and executives

- 495 verified contact emails for direct engagement

- Ideal for fund managers, developers, advisors, and placement agents

Format: Excel (.xlsx)

Delivery: Manually sent within 24 hours after purchase

Payment: PayPal or Credit Card via secure checkout – No Refunds on Database Sales

View The YouTube Video Description Below

🌍 The Expanding Power of Middle East Family Investment Offices: Mapping Global Capital Influence (2022–2025)

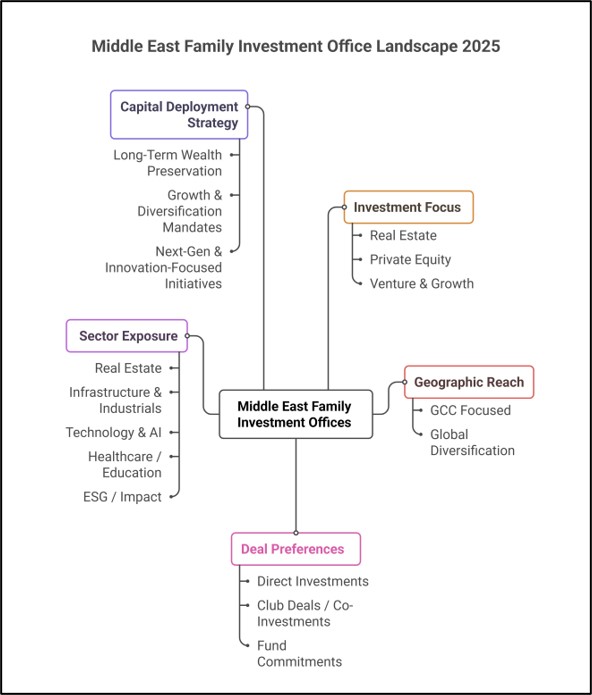

After reviewing my proprietary Middle East Family Investment Office (FIO) Database, I’ve outlined key insights into where private family capital from the GCC and broader MENA region is deploying – and why these families have become some of the world’s most strategic long-term investors in real estate, private equity, and diversified global assets.

Over the 2022–2025 period, more than 65% of active Middle East FIOs have increased direct allocations to cross-border private investments – particularly in real estate, energy transition, logistics, and next-generation tech infrastructure. These families represent a unique hybrid of private capital and sovereign-scale wealth, offering unmatched access to flexible, discretionary investment capital.

Across Saudi Arabia, UAE, Kuwait, Qatar, and Bahrain, this database captures a verified cross-section of 420+ active Family Investment Offices with confirmed deal flow in institutional-grade assets. Together, they form one of the most powerful private capital ecosystems outside the global fund management industry.

🏢 Real Estate: The Dominant Asset Class

Roughly 72% of all profiled Middle East Family Offices maintain active real estate portfolios – a higher share than any other investor type in the region.

Of this group, approximately:

- 46% focus on core and core-plus income-generating assets (Class A residential, logistics, hospitality).

- 21% are pursuing value-add or opportunistic strategies, often via joint ventures with US or European sponsors.

- 5% engage in development partnerships or direct acquisitions of land for long-term legacy holdings.

Examples include:

- Al Ghurair Investment (UAE) – diversified family group with a global portfolio in industrial and commercial real estate.

- Sedco Holding (Saudi Arabia) – active in hospitality, multifamily, and private equity real estate funds.

- Al Nowais Investments (Abu Dhabi) – combines direct property investments with energy and infrastructure holdings.

This continued real estate dominance reflects the FIO preference for tangible, cash-flowing assets – viewed as both a wealth preservation tool and an inflation hedge amid global market volatility.

💼 Expanding Private Equity & Co-Investment Strategies

Approximately 60% of FIOs in the database now maintain a Private Equity or Direct Investment division, often mirroring institutional fund models.

Of these:

- 30% allocate to buyouts, growth, and control positions in operating companies.

- 18% participate as LPs or co-investors alongside private equity sponsors.

- 12% pursue venture and innovation capital, particularly in AI, fintech, and sustainability-linked ventures.

Notably, UAE-based and Saudi FIOs account for nearly 70% of all outbound family private equity investments – often targeting the US and UK markets for scale, and Southeast Asia for growth.

🌏 Sector Diversification: Beyond Oil and Real Estate

While real estate and PE remain dominant, roughly 40% of Middle East FIOs are diversifying into thematic sectors:

- 17% into renewable energy and decarbonization assets.

- 12% into technology and venture capital (AI, deep tech, fintech).

- 8% into healthcare, education, and life sciences.

- 3% into agribusiness and food security ventures.

This shift reflects a broader “Next-Gen Family Capital” movement – where younger family principals are professionalizing investment structures, aligning with institutional ESG standards, and pursuing global co-investments rather than passive holdings.

🏦 Regional Investment Hubs & Global Reach

The FIO capital network is anchored by UAE and Saudi Arabia, which together represent over 60% of total identifiable family wealth activity in the region.

Key hubs include:

- Dubai and Abu Dhabi – regional headquarters for global diversification strategies.

- Riyadh and Jeddah – home to legacy merchant families expanding into institutional private equity.

- Doha, Manama, and Kuwait City – maintaining strong outbound partnerships into Europe, Africa, and Asia.

Importantly, nearly 45% of all active FIOs in the database have established investment entities in London, Luxembourg, or Singapore, reinforcing their evolution into global capital allocators with institutional-grade reach.

📈 Evolving from Legacy Wealth to Institutional Platforms

The modern Middle East FIO is no longer a passive asset holder – it is a family-controlled investment institution.

Key trends shaping this shift include:

- Professionalization of in-house investment teams (CIOs, investment committees).

- Creation of multi-sector holding structures (real estate, PE, VC, and direct investments under one platform).

- Co-investment partnerships with US and European fund managers seeking aligned capital.

- Integration of ESG, impact, and Sharia-compliant frameworks in deal screening.

Roughly 52% of FIOs in the dataset now operate as hybrid family funds – blending generational wealth preservation with institutional-style deal execution.

💬 Closing Insight

Middle East Family Offices are redefining what private capital means in 2025 – long-term, globally integrated, and partnership-driven.

Their investment behavior increasingly mirrors sovereign wealth funds, but with greater agility and confidentiality.

For fund managers, developers, and advisors, these are the ultimate limited partners and co-investors – capable of deploying $20M–$500M+ into strategic deals across real assets, private equity, and technology.

This isn’t just capital – it’s legacy-driven investment power, reshaping global private markets from Dubai to New York.

📅 October 2025 – ✍️ Written by Andrew Thomas – The Investors Link

🔗 See my exclusive Middle East Family Investment Office Database if you are raising capital or seeking strategic partnerships with Gulf family capital.

Understanding Family Offices in the GCC: Profiles and Patterns from 50 Regional Investors – A Preview of 2026 Fundraising

Family offices across the Gulf Cooperation Council represent one of the most influential private capital pools in global markets. With deep liquidity, multigenerational continuity, and sector expertise built from decades of operating businesses, these families play a central role in private equity, venture capital, real estate, and strategic cross-border investment.

This article draws from a broader Middle East database containing more than four hundred and twenty five family investment offices. The fifty profiles reviewed for this preview capture a varied cross section that illustrates the region’s institutional shift, its expanding sector priorities, and its readiness for global investment deployment in 2026.

1. Legacy Conglomerate-Backed Family Offices

🏛️ These groups evolved from major trading families and diversified corporate houses. Their investment offices operate with scale, governance, and international reach.

• Al Ghurair Group (UAE) with holdings in petrochemicals, metals, packaging, and regional real estate.

• Al Fahim Group (UAE) active in automotive, industrial services, hospitality, and property.

• DICO Group (UAE) representing the Sajwani family with global exposure in real estate, hospitality, manufacturing, and consumer sectors.

• Alghanim Industries (Kuwait) an expansive multi-sector portfolio covering FMCG, logistics, travel, steel, and financial services.

• Ali and Sons (UAE) with interests in automotive, oil and gas, retail, construction, marine engineering, IT, and property management.

• Abudawood Group (Saudi Arabia) a historic trading family with distribution interests across the GCC, South Asia, and North Africa.

These groups operate with multigenerational oversight, established governance committees, and structured investment processes that mirror institutional allocators.

2. Diversified Single Family Offices with Global Mandates

🌐 Many families have transitioned from operating businesses to holding companies supported by professional investment teams.

• Electra Real Estate (Israel) focused on multifamily, single family rental, and commercial real estate across the United States and United Kingdom.

• Ardaas Holdings (UAE) with sector exposure in education, renewable energy, and agriculture.

• Areef Investments (UAE) managing diversified local and international holdings.

• Majid Al Futtaim Trust (UAE) aligned with global real estate, lifestyle, leisure, and retail investments.

• MMR Kassam Investments (Dubai) overseeing cross-border multi sector allocations.

• Al Braik Investments (UAE) with a mandate spanning real estate, oil and gas, hospitality, franchising, and infrastructure.

These modern offices often blend direct ownership with fund commitments and co-investments.

3. Emerging Next Generation Family Investment Platforms

📘 Post 2010 single family offices reflect the priorities of younger family members who prefer diversification, international exposure, and alternative assets.

• Sabban Holdings (Dubai, 2013) directing capital into alternative and private markets.

• Equalis Capital (Dubai, 2013) providing structured, globally oriented investment oversight.

• AlRajhi United (Saudi Arabia, 2010) an investment platform linked to one of the most prominent families in the kingdom.

• Ajyad Economic Company Limited (Saudi Arabia, 2018) representing a newer generation of private capital owners.

• HWH Investments (UAE, 2013) diversified into finance, construction, and technology.

• Narmo Capital (Saudi Arabia and Bahrain, 2014) serving the Al Omran family and several additional Saudi families.

These groups frequently prioritize exposure to venture capital, technology, thematic strategies, climate solutions, and global real assets.

4. Established Investment Offices with Sector Strength

🔧 These offices maintain clear sectoral advantages drawn from decades of operating experience.

• Quadro Capital Partners (UAE) invested in connectivity logistics, fintech, infrastructure, and broader financial services.

• SEED Group (UAE) aligned with technology, healthcare, tourism, hospitality, and real estate.

• SOZA Capital Consultants (UAE) emerging from the Zarouni family, involved in financial services, insurance, capital markets, healthcare, and communications.

• 21 North Advisors (Bahrain) managing conservative allocations for wealthy families.

• Jaidah Group (Qatar) diversified across automotive, heavy equipment, industrial supply, technology, and energy.

Their investment strategies typically combine direct ownership with institutional partnerships and sector driven expansion.

5. Multi Family Offices Providing Institutional Governance

👥 These platforms support families seeking independent oversight, structured allocation frameworks, and diversified access.

• FP Consilium (Lebanon, 2008) with advisory led wealth management capabilities.

• IOME Private Investment Office (Saudi Arabia) a women led multi family office with strong alignment to Riyadh based UHNW families.

• Cukierman Family Office (Israel) supported by a robust asset allocation framework and access to Cukierman Investment House.

Demand for multi family office structures continues to grow as families pursue professional governance without internalizing full investment teams.

6. Investment Offices Integrating International Expansion

✈️ A number of families reviewed show increasing interest in cross-border partnerships, direct transactions, and global real asset platforms.

• Electra Real Estate focusing on North American and UK real estate.

• Al Ghurair Group, Alghanim Industries, and Abudawood Group maintaining footprints across the Middle East, North America, Europe, Asia, and Africa.

• DICO Group with a global hospitality and real estate profile that mirrors institutional allocators.

These patterns highlight a continued shift toward global risk management, geographic diversification, and direct control over international holdings.

Key Themes Identified Across the Fifty Profiles

🧩 Several patterns consistently emerge across the reviewed family offices.

• Preference for co investment structures alongside trusted fund managers.

• Gradual rotation from GCC real estate into international alternative asset classes.

• Rising interest in climate solutions, renewable energy, and sustainability linked strategies.

• Strong appetite for structured private equity, secondaries, and specialized real asset strategies.

• Governance models increasingly aligned with institutional best practices.

• Ongoing strengthening of global networks, particularly in North America, Europe, and parts of Asia.

These characteristics position GCC family offices as stable, long horizon capital partners for 2026 and beyond.

Conclusion

The GCC family office ecosystem is expanding in sophistication, scale, and global influence. Legacy groups maintain their dominance, new offices reflect the ambitions of younger generations, and multi family offices support the rising demand for structured oversight. As 2026 approaches, these investment offices will play a central role in private markets, real assets, and thematic global investment strategies.

December 2025 ✍️ Written by Andrew Thomas – The Investors Link

📘 Explore the Middle East Family Investment Office Database

If you are raising capital or seeking strategic partnerships with Gulf family investors, this structured database provides detailed profiles, investment themes, and relationship-ready intelligence across more than four hundred groups.

🏛️ Middle East Family Investment Offices

Capital Allocation Structures, Investment Behavior, and Institutional Intelligence

Middle East Family Investment Offices have emerged as some of the most influential private capital allocators in global markets. Across the Gulf Cooperation Council, these family controlled investment platforms manage multi generational wealth through structured mandates, professional governance, and long term capital deployment strategies.

For fund managers, developers, and advisors, engaging Middle East family capital requires a clear understanding of how these offices allocate capital, evaluate opportunities, and structure investment decisions. This article provides an institutional analysis based on verified data from the Middle East Family Investment Office Database, covering more than four hundred active Family Investment Offices across the UAE, Saudi Arabia, and the wider GCC.

📊 Evolution of Middle East Family Investment Offices

Historically, Middle East family wealth was managed through operating businesses and informal holding structures. Over the past fifteen years, this model has shifted decisively toward institutional investment platforms.

Today, Family Investment Offices in the GCC operate as standalone capital allocation entities with defined mandates, investment committees, and professional management teams. This evolution reflects a deliberate move away from opportunistic investing toward disciplined portfolio construction.

Key drivers of this transition include generational succession, international diversification, regulatory complexity, and increased exposure to private markets.

🧭 Core Capital Allocation Frameworks in the GCC

While mandates differ by family, most Middle East Family Investment Offices allocate capital across three primary segments.

🏢 Core and Defensive Capital

This allocation prioritizes capital preservation and income stability. Real estate remains the dominant asset class, particularly income generating residential, logistics, hospitality, and mixed use assets.

Holdings are typically structured through direct ownership, joint ventures, or family controlled platforms. Capital in this segment is long duration and illiquid, requiring fund managers to demonstrate asset quality, downside protection, and jurisdictional resilience.

📈 Growth and Institutional Alternatives

This segment includes private equity funds, direct operating company investments, co investment structures, and selective private credit strategies.

In this category, GCC Family Investment Offices operate similarly to institutional LPs. They conduct formal due diligence, benchmark managers, and often negotiate fee structures or co investment rights.

Alignment with mandate, strategy maturity, and manager credibility are critical at this stage.

🚀 Strategic and Next Generation Capital

An expanding portion of capital is allocated to venture capital, technology, energy transition, and thematic strategies. This allocation is often influenced by next generation family members and professional CIOs.

Although smaller in percentage terms, this segment represents one of the most accessible entry points for differentiated fund managers seeking Middle East capital.

🧠 Governance and Investment Decision Making

Contrary to common assumptions, investment decisions within Middle East Family Investment Offices are rarely centralized with a single individual.

Most offices operate investment committees that include family principals, professional executives, and external advisors. These committees review opportunities within defined allocation windows and apply strict mandate filters.

Timing, relevance, and strategic fit are therefore critical factors in successful fundraising.

🌍 Regional Differences Across GCC Family Offices

Family Investment Offices across the GCC do not behave uniformly.

- United Arab Emirates based offices often act as global allocators with established international investment vehicles and professional investment teams.

- Saudi Arabia Family Investment Offices increasingly align with Vision 2030 themes, domestic development, and strategic international partnerships.

- Kuwait and Qatar based families tend to emphasize conservative deployment, capital preservation, and long holding periods.

The Middle East Family Investment Office Database reflects these jurisdictional distinctions, enabling targeted and region specific outreach.

❌ Why Generic Family Office Lists Are Ineffective

Public Family Office lists are not designed for institutional fundraising.

Common issues include outdated structures, misclassified entities, lack of investment activity verification, and incorrect identification of decision makers. Most lists fail to indicate whether an office actively invests in funds, prefers direct deals, or is currently deploying capital at all.

Without verified intelligence, outreach becomes inefficient and misaligned.

🗂️ What the Middle East Family Investment Office Database Provides

The Middle East Family Investment Office Database is built to support institutional grade capital engagement.

Each Family Investment Office included has been verified as an active investor with confirmed private market exposure. The database enables users to segment and prioritize prospects based on real allocation behavior rather than assumptions.

Key intelligence includes:

- Active asset class focus across real estate, private equity, infrastructure, and venture capital

- Typical investment ticket sizes and co investment preferences

- Geographic deployment patterns across GCC, Europe, North America, and Asia

- Governance structure and decision making frameworks

- Professionalized versus family led investment models

This level of detail materially improves fundraising efficiency and credibility.

🎯 Capital Alignment Versus Capital Access

Access to Middle East family capital is not the primary challenge. Alignment is.

Family Investment Offices value informed engagement, strategic relevance, and long term partnership potential. Fund managers who understand portfolio construction, mandate constraints, and regional priorities are far more likely to secure meaningful dialogue.

The database is designed to support this alignment by replacing broad outreach with targeted, evidence based engagement.

🌐 The Strategic Role of GCC Family Offices in Global Private Markets

Middle East Family Investment Offices increasingly operate alongside sovereign wealth funds, pension plans, and endowments as peers in global private markets.

Their capital is patient, flexible, and often unconstrained by short term liquidity requirements. This positions them as ideal partners for long duration real assets, private equity strategies, and cross border development projects.

For many fund managers, GCC Family Offices represent not only capital, but continuity across multiple fund cycles.

🧩 Conclusion: Institutional Intelligence as a Competitive Advantage

Middle East Family Investment Offices are no longer informal pools of private wealth. They are family controlled investment institutions with global reach, institutional discipline, and long term horizons.

Successfully engaging this capital requires verified intelligence, structural understanding, and disciplined targeting.

The Middle East Family Investment Office Database exists to meet that requirement.

December 2025 ✍️ Written by Andrew Thomas – The Investors Link

📘 Explore the Middle East Family Investment Office Database

If you are raising capital or seeking strategic partnerships with Gulf family investors, this structured database provides detailed profiles, investment themes, and relationship-ready intelligence across more than four hundred groups.