🏢 Institutional Real Estate Investors Databases (2025 Edition)

Gain verified access to the world’s largest database of institutional investors actively allocating capital to real estate and real assets.

This exclusive dataset features 13,600 global institutions, fully updated for 2025, representing the most comprehensive coverage of real estate capital sources available.

🌍 What’s Inside

Each profile is drawn from verified institutional filings, fund commitments, and investor disclosures — delivering actionable, investment-grade intelligence for professionals raising or deploying real estate capital.

Investor Types Covered:

- Sovereign Wealth Funds

- Pension Funds (Public & Private)

- Insurance Companies

- Investment & Asset Management Firms

- Family Investment Offices

- Banks & Investment Companies

- Endowments & Foundations

- Superannuation Schemes

- Fund-of-Funds & Real Estate Fund Managers

- Infrastructure & Real Assets Investors

Unlike generic contact directories, this dataset isolates active allocators — institutions with confirmed real estate mandates, allocation programs, or property exposure.

Every contact is verified for activity, ownership, and sector relevance.

💼 Why It Matters

Institutional investors control the vast majority of global property capital.

This database provides direct visibility into the firms deploying equity into development projects, funds, joint ventures, and strategic real estate partnerships.

Ideal for:

- Fund Managers & Developers

- Investment Advisors & Placement Agents

- Institutional Capital Partners

- Private Equity Real Estate Professionals

📊 Database Details

- 13,600 Verified Institutional Investor Firms

- 50,500 Key Contacts

- 31,500 Key Contacts Emails

- Global Coverage: North America, Europe, Middle East, Asia-Pacific

- Structured by: Institution Type, Investment Focus, and Real Estate Allocation

- Format: Excel (.xlsx)

- Delivery: Manual dispatch within 24 hours of payment

- Payment Options: PayPal or Credit Card – No Refunds on Database sales

View the Database Details on the Video Below

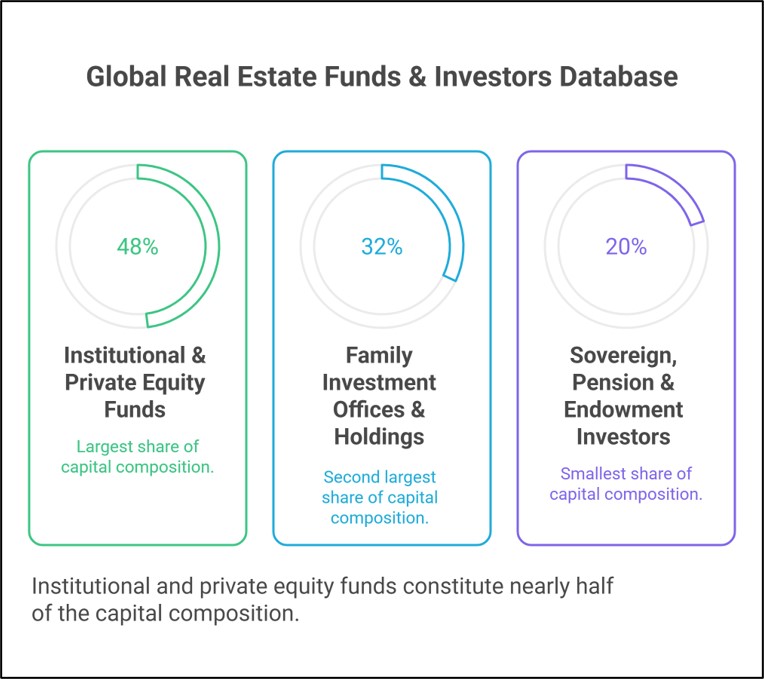

🏢 Global Real Estate Fund Investors Database (2025 Edition)

Gain verified access to one of the world’s most exclusive and targeted databases of institutional Real Estate Funds – featuring over 4,000 global funds actively allocating to property, infrastructure, and related real assets.

Compiled from verified institutional filings and fund disclosures from 2022–2025, this dataset represents the most comprehensive, up-to-date coverage of institutional real estate capital worldwide.

🌍 What’s Inside

Each profile includes fund ownership details, AUM range, investment strategy, and geographic focus — sourced from confirmed institutional records.

It’s designed to provide actionable intelligence for professionals raising or deploying capital across the real estate value chain.

• Core, Value-Add & Opportunistic Real Estate Funds

• Private Equity Real Estate Platforms

• Institutional REITs & Fund Managers

• Pension & Insurance-Backed Real Estate Vehicles

• Sovereign Wealth-Linked Funds

• Endowment & Foundation Allocators

• Family Office-Managed Funds

• Global and Regional Fund-of-Funds

Unlike generic investor directories, this dataset isolates funds with confirmed real estate mandates and active deployment programs – not passive holders.

Every fund is verified for investment activity, sector relevance, and current portfolio exposure.

💼 Why It Matters

These institutional real estate funds are among the most sought-after capital partners worldwide.

This database enables direct engagement with the fund managers and decision-makers behind active real estate vehicles seeking investments, co-investment opportunities, and partnerships.

Ideal for:

• Developers & Fund Sponsors

• Capital Advisors & Placement Agents

• Institutional Real Estate Consultants

• Private Equity Real Estate Professionals

📊 Database Details

• 4,000 Verified Real Estate Funds (2022–2025)

• 9,700+ Key Contacts

• 7,700+ Verified Emails

• Global Coverage: North America, Europe, Middle East, Asia-Pacific

• Structured by: Fund Type, Strategy, and Regional Focus

• Format: Excel (.xlsx)

• Delivery: Manual dispatch within 24 hours of payment

• Payment Options: PayPal or Credit Card — No Refunds on Database Sales

View the Database Details on the Video Below

🌍 The Global Expansion of Real Estate Fund Formation: Mapping Institutional Capital Flows (2022–2025)

After reviewing my proprietary Real Estate Fund Investors Database, I’ve outlined several key observations on where institutional and private capital is currently being deployed across the global property and real assets sector.

Between 2022 and 2025, the real estate investment landscape has seen a strong rebound – with over 4,000 active funds verified in my database, representing both new launches and capital programs actively deploying into real estate, infrastructure, and income-generating property assets worldwide.

From sovereign and pension-backed vehicles to independent private equity real estate (PERE) platforms, institutional fund formation has accelerated across North America, Europe, the Middle East, and Asia-Pacific – signaling renewed global appetite for hard-asset exposure amid inflationary pressure and volatile public markets.

🏙 The Core-to-Value-Add Shift

Roughly 60% of the new funds launched between 2022 and 2025 target Core-Plus and Value-Add strategies, emphasizing repositioning, operational optimization, and rental growth potential.

This marks a gradual shift from passive Core holdings to more active capital deployment – a pattern most visible in the U.S., Europe, and Australia.

Examples include:

- Heitman Core-Plus Fund V (US/Europe) – pursuing income growth through operational improvements.

- Patrizia PERE IV (Germany) – value-add and logistics repositioning across EU gateways.

- Gulf Capital Real Estate Fund II (UAE) – hybrid Core-Plus / opportunistic strategies across GCC hospitality and multifamily.

These vehicles aim to capture risk-adjusted returns of 10–14% IRR, signaling a middle-ground preference between stable income and tactical appreciation.

🧩 The Rise of Thematic and Sector-Focused Vehicles

Post-2022, a growing number of real estate funds are narrowing their mandates – prioritizing single-sector exposure or specialized income strategies.

Leading examples include:

- Industrial & Logistics: EQT Exeter Fund IV, Clarion Partners Logistics Fund, and ESR Kendall Square RE Fund (Asia).

- Residential / Multifamily: GID Partners, CBRE IM Multifamily Fund VIII, and Abu Dhabi’s Aldar Living Platform.

- Healthcare & Senior Living: Harrison Street Real Estate Partners IX, AXA IM Healthcare Fund.

- Hospitality & Tourism: Ennismore Development Partners, Kingdom Hotel Investments II.

This sectoral specialization reflects investor demand for resilience and thematic clarity – with industrial and multifamily still dominating allocation pipelines.

🌏 Regional Trends in Fund Formation

North America continues to lead in fundraising volume, driven by U.S. and Canadian managers pursuing institutional mandates across logistics, multifamily, and debt strategies.

Europe remains active, particularly among mid-market value-add funds in the Nordics, DACH, and UK regions.

The Middle East is emerging as both a capital source and destination – with sovereign-linked and Shariah-compliant vehicles targeting hospitality, residential, and logistics assets.

Asia-Pacific demonstrates deep growth in mixed-use and industrial developments, especially across Japan, South Korea, and Australia.

Collectively, these regions now represent the most diversified real estate capital landscape since 2019.

💡 Institutionalization and Alternative Allocations

Roughly 25–30% of all funds verified between 2022–2025 are classified as Institutional Real Estate Funds backed by pension plans, insurers, and sovereign wealth vehicles.

Another 15% focus on Real Estate Debt – targeting senior and mezzanine loans to capitalize on high-rate environments and liquidity gaps among traditional lenders.

This reflects a more structured, institutionalized capital cycle where diversified yield and inflation-hedged returns are prioritized.

📈 Real Estate Fund Snapshot (2022–2025)

| Strategy Type | % of Funds | Example Funds | Typical Size (USD) |

| Core / Core-Plus | 35% | Heitman Core-Plus V, Patrizia PERE IV | $250M – $1.2B |

| Value-Add | 25% | GID Partners, CBRE IM Multifamily VIII | $300M – $1.5B |

| Opportunistic / Distressed | 15% | Bain Capital RE II, Oaktree Fund X | $500M – $2.0B |

| Sector-Focused (Logistics, Resi, Healthcare) | 15% | ESR Kendall Square, AXA Healthcare | $100M – $800M |

| Debt / Credit Strategies | 10% | Nuveen Real Estate Debt II, PIMCO CRE Credit Fund | $250M – $1.0B |

🏗 What This Means for Sponsors and Capital Advisors

For fund sponsors, developers, and placement agents, this surge in diversified real estate fund formation signals both renewed opportunity and greater competition.

Institutional LPs are emphasizing manager track record, sector clarity, and regional depth – creating a premium for fund managers who can demonstrate operational expertise and transparent governance.

Meanwhile, emerging managers in secondary markets are finding success through co-GP structures and programmatic JV alliances with institutional allocators – particularly in logistics, residential, and build-to-rent sectors.

💬 Closing Insight

From mid-market value-add funds in London and Dubai to billion-dollar logistics platforms in Texas and Tokyo, the global real estate fund ecosystem is accelerating into its next cycle – characterized by specialization, sustainability, and institutional capital alignment.

What we’re witnessing is not just a rebound – but a redefined real estate capital market where verified fund transparency and cross-border partnerships drive global growth.

📅 October 2025 – ✍️ Written by Andrew Thomas – The Investors Link

🔗 See my exclusive Real Estate Funds Database if you are raising capital or seeking institutional partnerships in property, infrastructure, or real assets.

Real Estate Fundraising – Investor Profiling Case Study

💼 Building a Global Investor Targeting Strategy: Inside a $100 Million Real Estate Fundraise

This is a custom Investor Database and Fundraising program I created for one of my USA based RE Clients.

In today’s competitive capital markets, data-driven investor targeting forms the cornerstone of successful fundraising execution. For a U.S.-based real estate fund seeking to raise $100 million, a bespoke global investor database was created to connect qualified capital sources with institutional-grade property opportunities. This initiative was not just about compiling contacts – it was about creating a strategic capital intelligence system that aligned each investor with the fund’s value proposition, risk profile, and market relevance.

🗂️ A Data-Centric Foundation for Investor Outreach

The database incorporates over 14,000 verified decision-makers across 20 major investor categories, covering institutional, private, and corporate segments. Each profile was mapped by region, investment style, and engagement priority to ensure that every contact received a relevant and timely message.

- 🇺🇸 U.S. Real Estate Funds (890 targets, 1,009 contacts)

Messaging: “Institutional U.S. Real Estate Performance Opportunity” - 🇨🇦 Canadian Real Estate Funds (27 targets, 51 contacts)

Messaging: “Cross-Border Access to U.S. Income Assets” - 🌍 Middle East & Asia Institutional Investors

Messaging: “Gateway to U.S. Institutional Real Estate” and “Diversified Property Income Allocation” - 🇬🇧 European and UK Allocators

Messaging: “Stable Yield and Inflation-Hedged U.S. Real Estate Income”

Each segment receives a custom one-to-one email approach, designed to establish credibility and promote early-stage investor dialogue.

🧭 Precision Targeting: Aligning Message with Capital Mandates

The investor database was structured to distinguish between mandatory allocators and opportunistic allocators, a critical factor in maximizing engagement efficiency.

- 🏦 Mandatory Allocators (Pension, Insurance, Endowment Funds)

These investors are obligated to maintain real estate exposure within their portfolios.

Strategy: Bulk institutional campaigns emphasizing “Reliable Yield and Stable U.S. Exposure.” - 👨👩👧👦 Opportunistic Allocators (Family Offices, UHNWIs, RIAs, Asset Managers)

These investors prioritize strategic opportunities with strong downside protection and consistent cash flow.

Strategy: Personalized, relationship-based outreach highlighting “Stable Property-Backed Returns.”

Special attention is given to the UAE UHNW segment, which includes approximately 9,000 private investors. They will be engaged through selective email blasts and staged follow-up cycles to assess immediate interest in U.S. income-producing real estate. (Note: Access to this database is reserved for clients pursuing capital raises of at least US $50 million and engaged under a minimum six-month retainer agreement.)

✉️ Integrated Messaging and Channel Optimization

Each investor group receives a tailored core message anchored in their asset allocation priorities:

- 📈 Institutional Investors: “Reliable Yield, Stable U.S. Exposure”

- 🏘️ Family Offices & UHNWIs: “Stable Property-Backed Returns”

- 🧱 Corporate & Investment Companies: “Strategic Diversification into Real Assets”

Outreach is executed via two main channels:

- Custom One-to-One Sequences: Used for high-value, relationship-driven investors such as family offices and RIAs.

- Bulk Institutional Outreach: Applied to larger allocator categories like pension funds and insurance firms, optimizing reach and cost efficiency.

This dual-stream approach ensured the program could balance scalability with the personalized touch required for high-level investor engagement.

📊 Projected Campaign Performance Metrics

| Metric | Typical Industry Range (Investor & Financial Outreach) | Projected Performance |

|---|---|---|

| Open Rate | 28% – 42% | ≈11,900 opens (35% average – higher for manual, lower for bulk) |

| Click-Through Rate (CTR) | 3% – 7% | ≈1,530 clicks (linked decks & DD documents) |

| Positive Responses / Meeting Interest | 1.5% – 3% | ≈750 qualified replies or meeting requests |

| Conversion to Active Dialogue | 0.5% – 1% | ≈275–300 investor conversations directed to client team |

Note: These are typical industry email marketing results and are for illustration purposes only.

These benchmarks mirror institutional-grade investor outreach results observed in private equity and alternative investment marketing campaigns, where manual targeting yields significantly stronger engagement than mass sends.

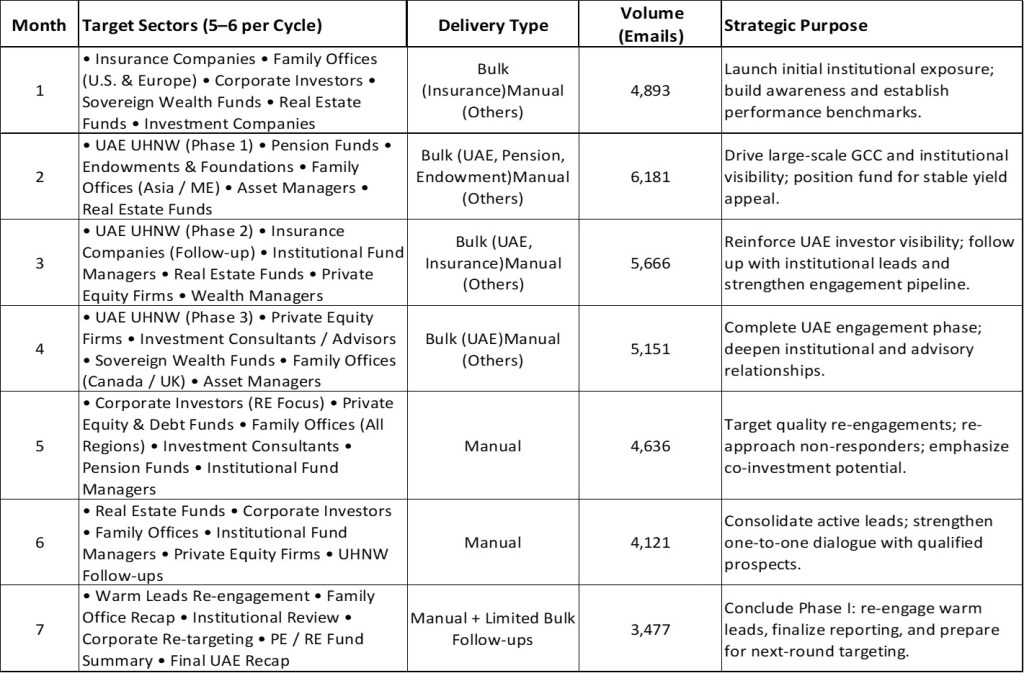

7-Month Investor Outreach Program Overview

Objective:

Execute a structured, seven-month global outreach campaign targeting over 34,000 institutional and private investors through a balanced mix of bulk and one-to-one communications. The program aims to optimize exposure, engagement, and qualified investor dialogue while refining targeting criteria monthly based on response analytics and deal alignment.

🌎 Conclusion: A Blueprint for Scalable, Data-Driven Fundraising

This project demonstrates how a structured, data-led investor intelligence model can transform traditional fundraising into a measurable, high-engagement process. By merging proprietary datasets, personalized messaging, and precise regional segmentation, the client now has a scalable roadmap to engage institutional allocators, family offices, and UHNW investors worldwide.

Each outreach sequence is designed not only to raise capital but to build long-term institutional partnerships and strengthen recognition among allocators seeking stable exposure to U.S. real estate assets. In short, this database serves as a fundraising infrastructure – one capable of connecting opportunity with capital, globally and intelligently.

Interested in the same program? Contact me for more information – Andrew Thomas – via the Contact Form on this website.

Great Places to Source Real Estate Capital in the United States in 2026 – Key Closed Funds to Watch!

A Data-Driven Outlook for Global Fund Managers

The closed real estate funds featured in this report are drawn exclusively from my Global Real Estate Funds Database and were selected based on verified allocation data and activity patterns updated through Q2 2025. Although we are now in late 2025, institutional real estate funds typically operate on deployment cycles that extend 18 to 36 months. These long term mandates allow us to identify managers that are positioned to remain active allocators well beyond 2026, given that closed funds typically deploy capital over multi year periods that can extend from three to seven years. This list is not a forecast but a data driven assessment grounded in sustained investment activity, consistent deal flow, and repeat commitments recorded across recent reporting cycles.

Closed real estate funds represent one of the most reliable sources of capital for sponsors seeking equity partnerships, development capital, structured solutions, and recapitalization support. Once a fund completes its raise, managers are obligated to deploy committed capital under well defined mandates, making these vehicles particularly relevant for developers, operators, and real estate companies entering 2026 with acquisition or development pipelines.

The United States continues to attract substantial institutional interest due to its liquidity, depth of product, and differentiated regional opportunities. With many funds now closed and entering their active allocation phase, the landscape offers tangible opportunities for real estate sponsors seeking credible capital partners. The following tables and profiles provide a detailed overview of this capital pool.

Closed Real Estate Funds Positioned for Deployment

The table below presents a representative sample of closed real estate funds that have completed their fundraising cycles and are positioned to deploy capital into the US market. These vehicles cover a range of strategies including value added, core, co investment, opportunistic, and sector specific mandates.

Table 1: Selected Closed Real Estate Funds in the United States

| Fund Name | Strategy | Status | Fund Size (USD M) | Primary Property Focus | Geography |

|---|---|---|---|---|---|

| Timberland Partners Apartment Fund IX | Value Added | Closed | 85 | Residential | United States |

| Beach Investment Fund II | Value Added | Closed | 84.5 | Residential | United States |

| HSRE OM Core Fund Co-Investment II | Core Co-Invest | Closed | 83.9 | Diversified | United States |

| Boston Financial California Fund II | Real Estate Debt | Closed | 83 | Residential and Senior Housing | United States |

| Clear Opportunities Fund I | Value Added | Closed | 83 | Diversified | United States |

| Harbour Equity JV Development Fund VI | Value Added | Closed | 82.5 | Residential | Canada with US direction |

| Arrowrock US Industrial Fund IV | Opportunistic | Closed | 82.3 | Industrial | United States |

| Leste 5 Pack Multifamily Fund | Value Added | Closed | 82 | Residential | United States |

| AREP Strategic Opportunity Fund IV | Value Added | Closed | 81.8 | Diversified | United States |

| Mastern US Private Real Estate Investment Trust 51 | Core | Closed | 81.66 | Residential | United States |

| Tioga Partners Fund III | Opportunistic | Closed | 80 | Diversified | Sun Belt United States |

| S3 SB Real Estate Capital Fund VI | Value Added | Closed | 78.6 | Diversified | United States |

| Gelfund Real Estate Opportunities 2 | Value Added | Closed | 76 | Residential | Northeastern United States |

| Marlin Spring Development Fund II | Value Added | Closed | 75.61 | Residential | Canada with US allocation potential |

| Blackstone Cognac Co-Investment Partners | Co-Invest | Closed | 75 | Diversified | United States |

| UBS Cold Storage Family Office Fund I | Opportunistic | Closed | 73.6 | Cold Storage, Logistics | United States |

| Third Lake RE SFR Fund II | Value Added | Closed | 73.4 | Single Family Rental | United States |

| Cinnaire Mid Atlantic Capital Fund 8 | Value Added | Closed | 73.3 | Residential | Mid Atlantic United States |

| DWF VI CF One Co-Invest | Co-Invest | Closed | 71 | Diversified | United States |

| Pixiu Woodbine Driskill | Core Plus | Closed | 70 | Hospitality | United States |

Strategic Deployment Themes Among Closed Funds

Closed funds give meaningful insight into where capital is moving. By reviewing commitments, strategy classifications, and sector themes, several clear patterns emerge for 2026 deployment.

Table 2: Strategy Distribution Across Closed Funds

| Strategy Category | Number of Funds in Dataset | Illustrative Examples |

|---|---|---|

| Value Added | High concentration | Timberland Partners Apartment Fund IX, Clear Opportunities Fund I, Leste 5 Pack Multifamily Fund |

| Opportunistic | Strong representation | Arrowrock US Industrial Fund IV, Tioga Partners Fund III, UBS Cold Storage Family Office Fund I |

| Core and Core Plus | Moderate share | Mastern US REIT 51, HSRE OM Core Co Investment II, Pixiu Woodbine Driskill |

| Co Investment Structures | Increasing prominence | Blackstone Cognac Co Investment Partners, DWF VI CF One Co Invest |

| Sector Specific and Thematic Funds | Growing segment | Boston Financial California Fund II, Third Lake RE SFR Fund II |

Key Observations

• The value added category remains dominant due to attractive pricing adjustments in multifamily, select office repositioning, and regional development opportunities.

• Opportunistic capital is targeting industrial development, cold storage, complex recapitalizations, and distressed situations.

• Co investment structures are becoming more popular as LPs seek alignment and deal level transparency.

• Specialist mandates such as single family rental, senior housing, and cold storage continue to appear in closed fund activity, reflecting structural demand drivers.

Sector Focus and Allocation Depth

Property type analysis shows a strong emphasis on residential themes combined with meaningful industrial and diversified exposure.

Table 3: Property Type Focus Among Closed Funds

| Primary Property Type | Representative Funds | Notes |

|---|---|---|

| Residential | Timberland Partners Apartment Fund IX, Beach Investment Fund II, Marlin Spring Development Fund II | Multifamily, senior living, and transit oriented developments show sustained appeal |

| Industrial and Logistics | Arrowrock US Industrial Fund IV, UBS Cold Storage Family Office Fund I | Supported by supply chain diversification and temperature controlled storage demand |

| Diversified Mandates | AREP Strategic Opportunity Fund IV, S3 SB Real Estate Capital Fund VI | Designed to capture repricing across multiple sectors |

| Hospitality | Pixiu Woodbine Driskill | Focused on restoration, repositioning, and heritage asset value |

| Single Family Rental | Third Lake RE SFR Fund II | Increasing institutionalization of SFR ownership |

| Affordable and Senior Living | Boston Financial California Fund II | Driven by federal and state incentives and demographic pressure |

Why Closed Funds Matter for Real Estate Sponsors in 2026

Closed funds represent a critical channel for capital raising because their investment timelines are committed, structured, and time bound. For real estate developers, operators, and GPs, this means:

• Capital is already raised and ready for deployment

• Managers are under formal mandates to execute transactions

• Strategies are clear, allowing for tailored deal sourcing

• Many closed funds seek co investment partners, JV structures, and programmatic relationships

• A diverse range of themes opens opportunities across residential, logistics, hospitality, and mixed use

In a market marked by repricing, interest rate adjustments, and regional divergence, sponsors that position themselves in front of active closed fund allocators will have a material advantage as 2026 unfolds.

Disclaimer

The information provided in this report is sourced from institutional grade databases and relies on third party information. Accuracy is based on the latest available reporting, but future investment activity cannot be guaranteed.

December 2025 – ✍️ Written by Andrew Thomas – The Investors Link

🔗 Explore my exclusive Real Estate Fund Database, a premium resource designed for fund managers and corporate leaders seeking access to global state capital, strategic co investment partners, and long horizon institutional allocators.

🌍 Global Hospitality and Hotels Real Estate Funds Positioned to Deploy Capital Through 2026

📊 A Data-Driven Sector Outlook from the Global Real Estate Funds Database

This report presents a curated analysis of 94 institutional hospitality and hotel-focused real estate funds drawn from my proprietary Global Real Estate Funds Database. These vehicles span North America, Europe, Asia-Pacific, the Middle East, and diversified global mandates, representing the most active capital allocators within the global hospitality sector.

The funds included were selected based on verified strategy classification, fund lifecycle status, fundraising activity, and observed deployment behavior, with data coverage updated through Q1 2025. Hospitality real estate funds typically operate on multi-year investment and repositioning cycles of 24 to 48 months, providing forward visibility into which vehicles maintain active acquisition mandates and uncalled capital extending into 2026.

This is not a projection of guaranteed capital commitments. It is a research-driven outlook based on capital formation trends, historical deployment velocity, repeat sponsor behavior, platform expansion, and sector-specific structural tailwinds.

🏨 Global Hospitality Real Estate Market Context

The hospitality and hotel sector has re-emerged as one of the most actively allocated real estate asset classes globally. Institutional investors increasingly view hospitality as an operational real asset capable of capturing revenue growth, inflation-linked pricing, and value creation through repositioning.

Key global drivers include:

🏖️ Recovery of international leisure and business travel

📈 Growth in experiential, lifestyle, and destination tourism

🏙️ Urban revitalization and rebranding opportunities

💼 Institutionalization of hotel operating platforms

🔄 Distressed and below-replacement-cost entry points in select markets

Hospitality has evolved from a cyclical allocation into a durable thematic strategy across global real estate portfolios.

📈 Market Research Overview: Hospitality Fund Activity Entering 2026

💰 Fund Size and Capital Deployment Characteristics

Table 1: Hospitality Fund Capital Profile (2022 to Q1 2025)

| Metric | Observed Range |

|---|---|

| Median fund size | USD 150m to 600m |

| Upper-tier platforms | USD 750m to 1.5bn |

| Core deployment rate | 8% to 15% annually |

| Value-added deployment rate | 15% to 25% annually |

| Opportunistic deployment rate | 20% to 30% annually |

| Core target net IRR | 7% to 9% |

| Value-added target net IRR | 11% to 15% |

| Opportunistic target net IRR | 16% to 22% |

Hospitality funds typically deploy capital faster than office or retail vehicles due to shorter acquisition timelines, smaller deal sizes, and platform-based sourcing strategies.

🧭 Dominant Strategic Themes Across Hospitality Funds

🏝️ Leisure and Destination Hospitality

Resort, wellness, and leisure-driven assets located in coastal, alpine, island, and tourism-centric destinations.

🏨 Urban Select-Service and Boutique Hotels

Value-added strategies targeting under-managed or under-branded urban assets in gateway and secondary cities.

🔧 Distressed and Post-Cycle Recovery Strategies

Opportunistic funds acquiring assets impacted by capital structure stress or operational disruption.

💳 Hospitality Credit and Structured Finance

Debt-focused strategies providing senior loans, mezzanine capital, and construction financing.

🌱 ESG, Wellness, and Experiential Hospitality

Sustainability-led redevelopment, wellness resorts, and environmentally aligned hospitality platforms.

🌐 Geographic Capital Deployment Patterns

Table 2: Regional Allocation Focus by Hospitality Funds

| Region | Capital Characteristics |

|---|---|

| North America | Select-service, branded urban hotels, repositioning strategies |

| Europe | Southern Europe, France, Germany, UK, pan-European tourism |

| Asia-Pacific | Japan-focused value plays, Australia leisure assets |

| Middle East | Tourism-driven development and lifestyle hospitality |

| Multi-Regional | Diversification across OECD hospitality markets |

🗂️ Hospitality Funds Positioned to Deploy Capital Through 2026

Funds were grouped by strategy type, deployment behavior, and mandate structure.

🏢 Group 1: Large-Scale Global and Regional Hospitality Platforms

Institutional sponsors with multi-fund hospitality programs and repeat capital cycles.

Representative Funds:

• MCR Hospitality Fund IV

• Rockbridge Hospitality Fund IX

• Pro-invest Asia-Pacific Hospitality Opportunity Fund III

• North Wind Banor Pan-European Hospitality Fund

• Japan Hospitality Fund I and II

• Lifestyle Hospitality Fund (Saudi Arabia)

📌 Commentary:

These platforms benefit from scale, operating depth, and long-term sponsor relationships, resulting in sustained acquisition activity regardless of market conditions.

🔄 Group 2: Value-Added and Repositioning Hospitality Funds

Funds focused on operational improvement, asset repositioning, and rebranding.

Representative Funds:

• Hospitality Transformation Fund 1

• HPI Real Estate Fund Series

• Mindston Hotels Signature

• LHG Hotel Fund II

• FREO Spanish Hotel Fund

📌 Commentary:

These vehicles are particularly active in fragmented ownership markets where operational inefficiencies create pricing dislocation.

⚠️ Group 3: Opportunistic, Distressed, and Special Situations Funds

Funds targeting distressed assets, opportunity zones, and complex capital stacks.

Representative Funds:

• Integris DLV Opportunity Zone Fund

• Linchris Capital Opportunity Fund III

• Lightstone QOF I

• Shopoff DLV QOZ Fund

• OREI Credit Fund III

📌 Commentary:

Capital deployment in this group accelerates during periods of market stress and refinancing pressure.

🧩 Group 4: Boutique, Single-Asset, and Niche Hospitality Vehicles

Smaller funds focused on specific assets, cities, or sub-sectors.

Representative Funds:

• PG single-deal hotel vehicles

• Pixiu Woodbine Driskill

• Crescent GPIF hotel partnerships

• Regional European and Australian hospitality funds

📌 Commentary:

While smaller in scale, these funds often deploy capital quickly and operate with shorter hold periods.

🌿 Group 5: ESG, Wellness, and Experiential Hospitality Funds

Thematic strategies aligned with sustainability and lifestyle trends.

Representative Funds:

• Safeguard Global Wellness Retreat Fund

• L’Organic Australia Wellness Resort Fund

• Hellenic Serviced Apartment Regeneration Fund

📌 Commentary:

Institutional demand for ESG-aligned hospitality exposure continues to expand, supporting long-term capital formation.

🔮 Conclusion: Hospitality Capital Deployment Outlook Through 2026

Hospitality and hotel real estate funds are positioned for sustained deployment through 2026, supported by structural tourism growth, operational upside, and improving global travel patterns. Compared to other property sectors, hospitality offers a compelling balance of income recovery and value creation.

🗃️ Positioning Within the Global Real Estate Funds Database

This hospitality and hotels report represents a sector-specific extract from the broader Global Real Estate Funds Database, which tracks institutional real estate vehicles across all major asset classes and geographies.

The database enables precise investor targeting through standardized fields including strategy type, fund status, geographic focus, capital size, and deployment behavior.

⚖️ Disclaimer

This report is based on third-party data, verified fund disclosures, and manager activity through Q1 2025. Fund strategies, capital availability, and timelines remain subject to change.

December 2025 – ✍️ Written by Andrew Thomas – The Investors Link

🔗 Explore the Global Real Estate Funds Database, the institutional-grade resource for identifying active hospitality, hotel, and real estate capital allocators worldwide.