Data-driven insight into real estate fund structures, fundraising conditions, and competitive positioning

Institutional Real Estate Fund Research and Competitive Landscape Analysis

This page highlights a recent institutional research project prepared for a real estate sponsor and illustrates the type of independent, data-driven analysis that can be commissioned by other real estate groups. Content is provided for informational and reference purposes only.

Recent Institutional Research Engagement

I recently completed a comprehensive institutional research report for a real estate sponsor preparing for a future fund launch and capital raising process. The research was designed to provide a clear, data-driven view of current real estate fundraising conditions and to position the sponsor’s proposed strategy within a highly competitive institutional landscape.

The work combined global fundraising benchmarks with a detailed peer analysis of comparable US-focused residential and multifamily funds actively raising capital.

Sample of Items Created for Real Estate Fundraising Research Project

A Replicable Research Service for Real Estate Fund Managers

This research is not a one-off study. It represents a repeatable institutional research service available to:

- Real estate fund managers and sponsors

- Groups planning first-time or early institutional raises

- Managers transitioning from self-raise to institutional capital

- Sponsors engaging placement agents or institutional allocators

Each engagement is built using my proprietary institutional-grade real estate fund database, curated to reflect the client’s strategy, geography, and target investor base.

Illustrative Outputs and Insights

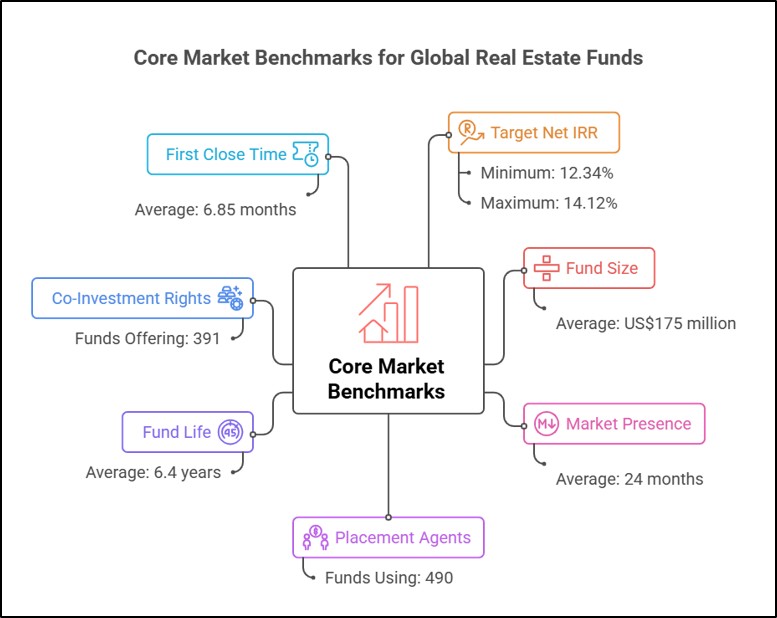

Market Benchmarking

- Average real estate fund time in market of approximately 24 months

- First closes typically reached after roughly 6–7 months

- Core and Core-Plus strategies dominate institutional residential fundraising

- Mid-market fund sizes remain the most competitive segment

Direct Competitive Mapping

- Identification of funds in close proximity by strategy, geography, size, and fundraising stage

- Clear separation between live capital competitors and reference benchmarks

- Practical context for investor allocation dynamics and timing risk

These insights are used to support internal planning, investor messaging, and fundraising readiness.

How Clients Use This Research

Clients typically use this research to:

- Inform fund launch strategy and pacing assumptions

- Support placement agent and investor discussions

- Demonstrate market awareness during due diligence

- Anchor return targets and fund structure in observable market data

The research is designed to complement legal, tax, and placement advisory work.

Investor Databases and Fundraising Intelligence

In addition to bespoke research, I provide curated investor databases and fundraising intelligence covering:

- Family offices

- Institutional investors

- Real estate-focused allocators

- Region-specific and strategy-specific investor targeting

These databases are frequently used alongside the research to support outreach planning and capital raising execution.

Engagement Format and Pricing Guidance

Typical engagements include:

- Custom institutional research report

- 20–75 pages, depending on scope

- Global benchmarks and direct peer analysis

- Excel-based datasets and written analysis

Indicative pricing:

USD 3,500 – 15,000, depending on analytical depth and customization. (Discount for Database Purchasers)

Positioning Statement

This page is intended to demonstrate the level of institutional research, market intelligence, and investor insight available to real estate sponsors through DubaiInvestorsList.com. Each engagement is bespoke and structured around the client’s fundraising objectives and investor profile.