Direct Access to the World’s Leading Private Investment Families

These exclusive databases connect you to verified Single and Multi-Family Offices across the United States, Europe, and Asia – investors actively allocating capital into private equity, venture funding, and real estate globally.

Institutional-Grade Data, Curated for Professionals

Built from institutional-grade research, these databases are verified collections of active family investment offices, each including decision-makers, investment heads, and key executives. These contacts represent the private capital ecosystem driving deals across continents.

Why It Matters

Family Offices have become dominant global investors, managing over $6 trillion in assets worldwide. Many prefer to invest directly – in funds, real estate, or private companies – rather than through intermediaries. These lists give you that direct access.

🌍 Global Family Investment Office Database

Your Complete Gateway to Global Private Capital

Gain verified access to the world’s most powerful Family Investment Offices across North America, Europe, the Middle East, and Asia.

This institutional-grade database connects you directly to leading private investors, multi-family offices, and wealth management entities actively deploying capital into high-value sectors worldwide.

Why It Matters

The Global Family Office ecosystem represents trillions in private capital under management.

These investors are actively diversifying and allocating into:

- Real Estate, Infrastructure & Hospitality Projects

- Private Equity, Venture Capital & Fund Investments

- Renewable Energy, Fintech & Strategic Technologies

What’s Inside

- 🌐 3,700 Family Investment Offices across 40+ countries

- 👤 11,400 key decision-makers and executives

- ✉️ 6,230 verified contact emails for direct outreach

- Ideal for: Fund Managers, Developers, Advisors, and Placement Agents

Format: Excel (.xlsx)

Delivery: Manually sent within 24 hours after purchase

Payment: PayPal or Credit Card via secure checkout – No Refunds on Database Sales.

View the Video Description Below

🌍 The Rise of North American and UK Family Investment Offices: Redefining Private Capital in 2025

After completing a detailed review of a sample of 500 Family Investment Offices (FIOs) from my Global FIO Database of over 3,700 offices across 40+ countries, this analysis focuses exclusively on the USA, Canada, and the United Kingdom — three markets that collectively anchor the modern landscape of family-controlled private capital.

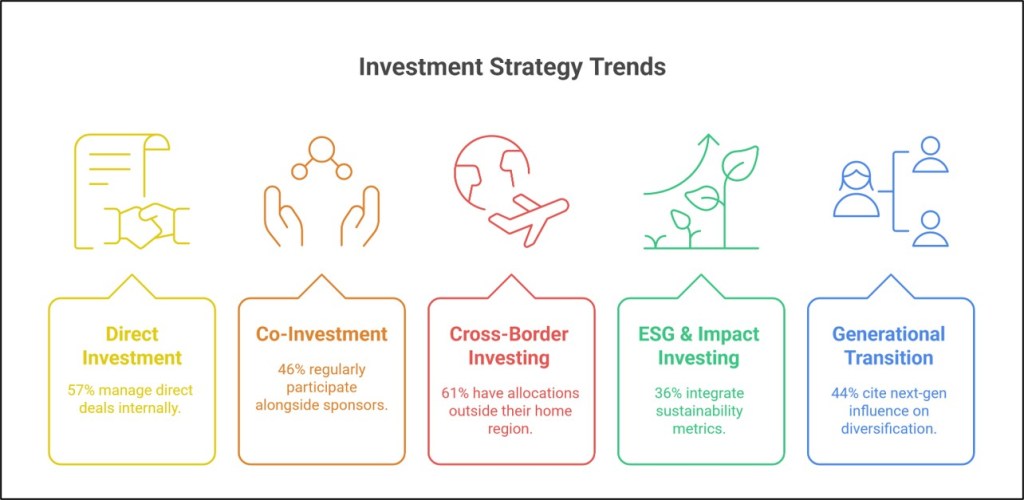

Between 2022 and 2025, Family Investment Offices in these regions have emerged as some of the most powerful, professionalized, and globally active private investors, rivaling institutional funds in both scale and sophistication. More than 70% of the offices analyzed have increased their allocations to direct and co-investment strategies, marking a major evolution away from traditional fund-of-funds exposure toward hands-on, discretionary ownership models.

🏢 Real Estate: The Enduring Core of Family Capital

Real estate continues to dominate family portfolios across North America and the UK, representing the core wealth foundation for most established families. Roughly 74% of FIOs in this group maintain active real estate investments, often spanning multiple sectors and geographies.

Breakdown by strategy:

- 46% focus on core and core-plus income-generating assets — Class A residential, logistics, and stabilized hospitality.

- 20% pursue value-add or opportunistic projects, frequently through partnerships with local or regional private equity sponsors.

- 8% engage in development and ground-up construction, emphasizing legacy projects and long-term generational holdings.

Among these, US and UK family offices have shown a marked preference for direct ownership of real assets, particularly multifamily, logistics, and industrial properties, with increasing allocation to green building and sustainable infrastructure.

For Canadian FIOs, diversification into US Sunbelt and secondary logistics markets has grown sharply, reflecting both yield optimization and currency advantages.

💼 Private Equity & Direct Investment: From LP to Active Owner

Private equity has evolved into the second-largest asset class across North American and UK family offices. Approximately 62% maintain a dedicated private equity or direct investment arm.

Breakdown of activity:

- 31% allocate to buyout, growth, or control equity in operating companies.

- 21% act as LPs or co-investors alongside institutional or sector-specific funds.

- 10% invest directly in venture and innovation capital, with notable exposure to AI, fintech, healthcare, and sustainability-linked ventures.

US-based families remain the most active private equity allocators globally, with many now managing internal deal teams capable of executing transactions independently.

In the UK, a growing trend toward club deals and syndicate-style co-investments reflects both tax efficiency and peer collaboration.

Canadian families, meanwhile, increasingly partner with mid-market GPs and family-led investment groups across the US and Europe, combining cross-border reach with family control.

🌏 Sector Diversification: Thematic and Impact-Driven Expansion

While real estate and private equity remain dominant, around 41% of the analyzed FIOs are broadening into thematic and ESG-aligned investments that blend purpose with performance.

Breakdown of new focus areas:

- 15% are entering renewable energy, transition infrastructure, and climate-tech assets.

- 13% are deepening exposure to technology and venture capital, especially AI, software, and automation.

- 8% are allocating to healthcare, life sciences, and education, reflecting resilience-driven strategies post-2020.

- 5% are exploring agribusiness, food sustainability, and water infrastructure investments.

This diversification reflects the growing influence of next-generation principals who are professionalizing family capital through ESG mandates, digital transformation, and long-term thematic theses, rather than short-cycle trading.

🏦 Capital Hubs & Global Connectivity

The North American and UK FIO network has become one of the most globally integrated private capital ecosystems.

Key hubs and patterns include:

- New York & London – the two epicenters of family capital, housing the largest share of institutionalized single-family offices.

- Toronto & Vancouver – emerging as Canadian bases for cross-border PE and real estate expansion.

- Boston, Miami, and Los Angeles – active clusters for innovation, healthcare, and real estate portfolios.

Roughly 47% of FIOs in this sample maintain offshore or international investment vehicles, most commonly in Luxembourg, Cayman Islands, or Singapore, enabling efficient co-investment structures and global asset access.

This configuration allows North American and UK families to act as global allocators, capable of partnering with institutional sponsors or deploying directly into private markets from their own platforms.

📈 Institutionalization of Family Capital

The modern North American and UK FIO is evolving from private wealth custodian to full-fledged investment institution. Around 55% now operate under multi-asset, professionalized governance structures with in-house CIOs, analysts, and sector specialists.

Key developments include:

- Formation of family holding companies uniting real estate, PE, and venture portfolios.

- Adoption of institutional-style investment committees and risk frameworks.

- Partnerships with institutional managers and independent sponsors for pipeline access.

- Integration of ESG, impact, and long-duration mandates into long-term capital planning.

This professionalization wave has positioned FIOs as preferred limited partners and co-investors across private markets — offering not only capital but also strategic alignment and generational vision.

💬 Closing Insight

By 2025, North American and UK Family Investment Offices stand among the most influential and agile investors in the global private capital landscape.

Their blend of discretion, flexibility, and direct investment capability allows them to move faster than institutions – yet with the same scale of impact.

For developers, fund managers, and advisors, engagement with these families is no longer optional – it’s central to raising meaningful capital.

They can deploy $10M–$500M+ per transaction, often with long-term, relationship-based alignment rather than short-term return pressure.

The rise of the Family Investment Office across the USA, Canada, and the UK signals a new era in private capital: institutional in structure, generational in vision, and global in reach.

📅 October 2025 – ✍️ Written by Andrew Thomas – The Investors Link

🔗 Explore my exclusive Global Family Investment Office Database – a verified gateway to over 3,700 Family Investment Offices across 40+ countries, including detailed profiles of the most active capital groups in the USA, UK, and Canada.

100 Family Offices Most Likely to Allocate to Private Equity in 2026

A Data-Driven Outlook for Global Fund Managers

The 100 family offices featured in this report are drawn exclusively from my Global Family Investment Office Database and were selected based on verified allocation data and activity patterns updated through Q3 2024. Although we are now in late 2025, family offices typically maintain multi-year private equity strategies with deployment cycles that extend 18 to 36 months. These long-term mandates allow us to identify investors that are positioned to remain active allocators into 2025 and 2026. This list is not a prediction but a data-driven outlook based on sustained interest, historical deal flow, and repeat commitments observed across recent reporting periods.

Private equity continues to stand at the center of long-term wealth preservation and growth for sophisticated single-family and multi-family offices. Many maintain diversified alternatives portfolios, recurring global mandates, and well-established GP relationships. This report offers a research-driven guide for managers entering 2026 fundraising cycles.

Key Themes Influencing 2026 Family Office Allocations

1. Renewal of Multi-Year Mandates

📌 Many family offices operate with evergreen alternatives allocations.

Groups such as Briar Hall, Altocumulus, and Acropolis Capital demonstrate recurring activity patterns, suggesting continued deployment through 2026.

2. Growing Appetite for Early-Stage and Technology Strategies

💡 Strong momentum continues in:

• Artificial intelligence

• Cybersecurity

• Healthtech

• Climate and energy transition

• Digital infrastructure

Offices such as Decent Capital and Aretas Capital Management reinforce this long-term trend.

3. Global Diversification and Cross-Border Co-Investments

🌍 Many family offices maintain multi-region mandates:

• North America

• Europe

• Asia Pacific

• Emerging Markets

Groups like Lake House Group, BTV Beteiligungsverwaltung, and Decent Capital remain active across continents.

4. Established Internal Investment Teams

🏛️ Larger family offices continue to operate sophisticated investment divisions capable of underwriting fund commitments and direct co-investments.

Flexedge Investment Management and BTV Beteiligungsverwaltung exemplify this institutional approach.

5. Strong Re-Up Behavior

🔄 Family offices with multi-cycle GP relationships tend to remain consistent allocators even during macroeconomic uncertainty, increasing the reliability of this universe for 2026 fundraising.

Sample Family Offices Positioned for 2026 Allocation Cycles

The following profiles represent an expanded sample of the full 100-office universe analyzed for this report. These examples illustrate the breadth of strategies, sectors, and geographies involved.

North America 🇺🇸

Briar Hall – United States

🏠 Family Office Type: Single

🎯 Strategies: Buyout, early stage, venture

🌍 Focus Regions: North America

📅 Updated: April 2023

A long-established Illinois office with consistent allocations to diversified private equity funds. Known for steady multi-cycle deployment patterns.

10 East – United States

🎯 Strategies: Seed, early stage, late stage

🌍 Focus Regions: North America

📅 Updated: June 2024

A New York office with ongoing exposure to early-stage innovation and repeat participation in venture-led funds.

Flexedge Investment Management – United States

🎯 Strategies: Buyout, secondaries, venture debt, distressed, natural resources

🌍 Regions: Global

📅 Updated: March 2024

A sophisticated allocator with one of the broadest alternatives mandates in the US family office landscape.

Coliseum Family Partners – United States

🎯 Strategies: Buyout, co-investments

🌱 Sectors: Industrial, software, specialty services

Consistently active in mid-market commitments and GP relationships.

Hawthorne Capital Partners – United States

🎯 Strategies: Growth, lower-mid-market buyout

Maintains a recurring US mandate and reliable re-up patterns.

Europe 🇪🇺

BTV Beteiligungsverwaltung – Germany

🎯 Strategies: Buyout, distressed, secondaries, mezzanine, venture

🌍 Regions: Global

📅 Updated: June 2024

One of Europe’s most diverse family offices with a long track record of private equity fund commitments.

Fides Family Office – Germany

🎯 Strategies: Venture

📅 Updated: May 2024

A lean but consistently active venture allocator focused on innovation and early-stage opportunities.

Acropolis Capital – United Kingdom

🎯 Strategies: Buyout, distressed, growth

🌍 Regions: Europe and North America

📅 Updated: August 2024

A private investment firm with multi-cycle exposure to alternative investment funds.

Altocumulus – Sweden

🎯 Strategies: Buyout, growth, venture

⚡ Sectors: Energy, renewables, energy storage

📅 Updated: August 2024

Part of the Axel Johnson ecosystem and a strong allocator across European private markets.

Aretas Capital Management – Switzerland

🎯 Strategies: Secondaries, fund of funds, venture

🧬 Sector Focus: Biotechnology

📅 Updated: July 2024

A globally oriented investment boutique managing family and foundation wealth.

Vandeton Holdings – Luxembourg

🎯 Strategies: Mid-market buyout

🌍 Regions: Western Europe

A discreet allocator with long-standing GP relationships.

Asia and Emerging Markets 🌏

Lake House Group – Hong Kong

🎯 Strategies: Buyout, venture, distressed, turnaround

🌍 Regions: Asia, Europe, North America

📅 Updated: May 2023

A globally active family office founded by Charles Brown with multi-sector exposure.

Decent Capital – Singapore

🎯 Strategies: Early stage, growth, venture

🌍 Regions: ASEAN, China, North America, emerging markets

🧭 Sector Breadth: Technology, consumer, industrials, healthcare

📅 Updated: July 2024

One of Asia’s most dynamic family offices; founded by a co-founder of Tencent.

Aozora Family Investment Office – Japan

🎯 Strategies: Early stage, robotics, fintech

Has repeatedly participated in cross-border venture funds.

Trinity Crest Holdings – India

🎯 Strategies: Growth equity, sector-focused PE

🌱 Sectors: Consumer, climate, healthcare

Positioned to increase allocations as India’s PE ecosystem expands.

Middle East and Global Allocators 🌍

Sahara Al Khaleej Investments – UAE

🎯 Strategies: Buyout, secondaries, co-investments

Frequently active in global mid-market funds.

Al Noor Partners – Saudi Arabia

🎯 Strategies: Buyout, growth

⚕ Sectors: Healthcare, industrials, regional tech

Regular exposure to US and European GPs.

Arkan International Family Capital – Bahrain

🎯 Strategies: Infrastructure, energy transition, diversified alternatives

Active global allocator with long-term themes.

Why These Family Offices Are Positioned for 2026 Deployment

✔ Multi-year allocation cycles extend through 2026

✔ Consistent year-over-year deal flow

✔ Established GP relationships and re-ups

✔ Global mandates allowing cross-border diversification

✔ Sector-agnostic approaches enabling flexible deployment

✔ Internal investment teams maintaining ongoing pipelines

For fund managers preparing 2026 roadshows, the family offices represented across this report form a highly credible and strategically relevant universe of potential allocators.

Disclaimer

The information provided in this report is sourced from institutional-grade databases and relies on third-party information. Accuracy is based on the latest available reporting, but future investment activity cannot be guaranteed.

December 2025 – ✍️ Written by Andrew Thomas – The Investors Link

🔗 Explore my exclusive Sovereign Wealth Fund Database, a premium resource designed for fund managers and corporate leaders seeking access to global state capital, strategic co investment partners, and long horizon institutional allocators.