Accelerate Your Capital Raise in 2026 with Direct Access to Verified Global Investors and the Middle East Family Office Investment Database

Your Gateway to Active Investors Across the World’s Capital Markets

The investor databases featured here are comprehensive, professional-grade datasets – continually updated and refined to reflect real capital activity across global markets. These are not broad or generic lists – they are carefully curated, high-fidelity networks built for corporate issuers, fund managers, and professional advisors who require precision.

To be clear, this is not a budget shortcut or a ‘magic bullet database’ that removes the real work of fundraising. It is an institutional-grade tool meant to support disciplined, strategic execution. These are professional lists for professional Fundraisers!

The databases span AI investors, early-stage and growth VCs, private equity and private credit groups, sovereign wealth funds, institutional real estate allocators, mining and mineral investors, and a full spectrum of global family offices. Every category is structured around verified decision-makers, current deployment trends, and authentic capital behavior, giving clients a clear view of who is actively investing, at what scale, and under what mandates.

In parallel with sector-specific datasets, clients gain access to country-focused institutional databases covering the U.S., Canada, Europe, the UK, the Middle East, India, Singapore, Hong Kong, and China – each built around investors who have raised or deployed capital since 2022. This structure supports highly targeted global outreach while ensuring that all engagement is grounded in reliable, current intelligence. For mandates requiring deeper customization, I also develop bespoke investor databases aligned to transaction size, sector focus, and capital strategy. Together, these resources form a comprehensive institutional platform designed to accelerate introductions, enhance investor alignment, and materially strengthen the execution of any corporate or professional fundraising program.

100 Middle East Real Estate Funds Positioned to Deploy Capital in 2026

The Middle East has emerged as one of the most active global sources of real estate capital, supported by national development agendas, resilient liquidity, and multi-year deployment cycles that extend well beyond 2025. Drawing on proprietary intelligence from the Middle East Funds Database, this report highlights the 100 regional real estate funds most likely to deploy capital in 2026. The analysis is based on verified allocation patterns, fundraising momentum, uncalled capital levels, and documented investment activity across Saudi Arabia, the UAE, Qatar, Kuwait, Bahrain, and Israel. It offers a rare, data-driven view into institutional strategies shaping next year’s deal flow.

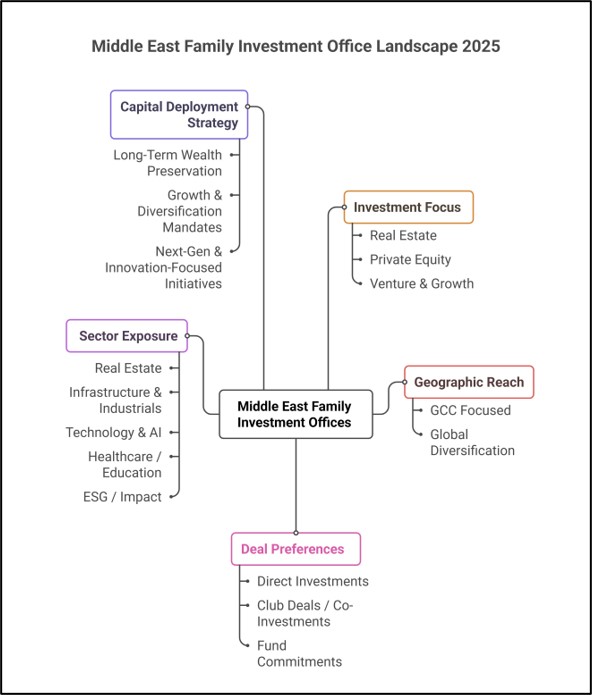

🌍 The Expanding Power of Middle East Family Investment Offices (2025)

Family Investment Offices (FIOs) across the GCC and wider MENA region have emerged as one of the most dynamic sources of private capital globally. Drawn from my proprietary database of 420+ verified FIOs, this report reveals how family wealth from Saudi Arabia, UAE, Kuwait, and Qatar is reshaping the global investment landscape.

Over 70% of these families maintain active real estate portfolios – with strong preferences for income-generating assets, logistics, and hospitality – while 60% have expanded into private equity and direct investments. Next-generation leaders are driving diversification into technology, renewable energy, and healthcare, aligning traditional family capital with institutional-style governance and ESG principles.

Nearly half now operate international investment entities in London, Luxembourg, or Singapore, positioning the Middle East as a global capital hub. With flexible mandates and transaction capacities of $20M–$500M+, these family offices represent one of the most influential and strategic forces in global private markets.

Verified contacts, sector focus, and decision-maker emails – manually curated from institutional sources!

Dubai C-Suite & Board-Level Executive Directory – 70,000 Contacts

New for 2026!

Dubai is not only a global hub for private wealth. It is also home to a dense concentration of corporate decision makers, founders, and board level executives who influence capital allocation across the Middle East. To complement our Dubai HNW and UHNW investor coverage, we maintain a continuously validated Dubai C-Suite and Board-Level Executive Directory, designed to provide structured access to senior corporate leadership rather than broad, untargeted contact lists.

This directory has been refined to support capital raising, strategic engagement, and investor education initiatives where understanding who influences capital decisions is as important as identifying formal investors. Each record is categorized by role and seniority and independently validated to prioritize accuracy and relevance over volume. Further details on the scope, structure, and use cases of the Dubai C-Suite & Board-Level Executive Directory can be found on the dedicated page.

There’s a reason my Custom Real Estate Fundraising Database, highlighted below, is worth $10,000. It’s not public – it’s powerful – and only a handful of my clients ever gain access!

SEE HOW I HELP REAL ESTATE GROUPS WITH CUSTOM FUNDRAISING DATABASES

How can anyone value an Investor Database at $10,000? Relax, that is not what I charge for it. But when you’re raising $100 million in equity, precision matters. This isn’t just a database – it’s a fully refined Fundraising Strategy, executed over a 7-month program as part of my exclusive retainer package. It’s a strategic tool designed to save months of wasted outreach and put you directly in front of active, verified investors who are already deploying capital. Let others chase $100 databases scraped from the web and sold by low-quality list providers – while you’re already securing meetings and advancing toward $25 million, $50 million, or even $100 million+ in funding.

Custom Investor Targeting Strategy and Database Overview

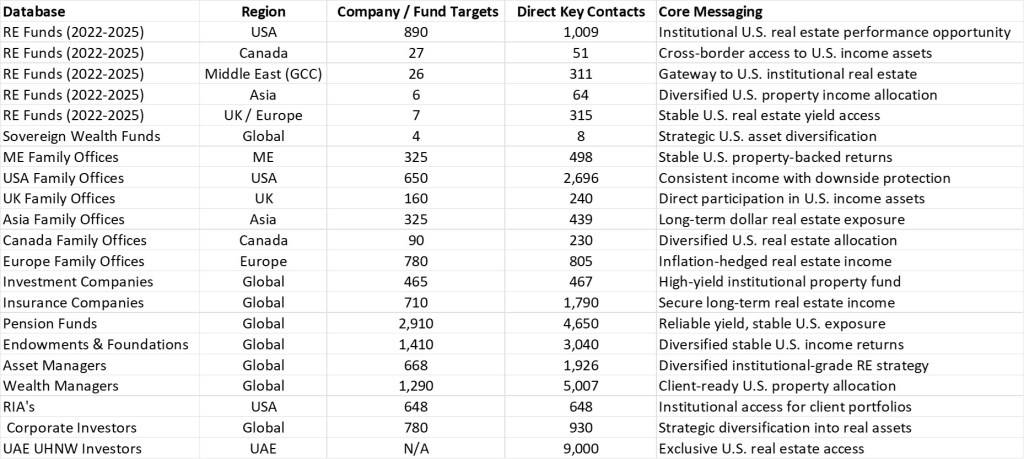

To support a U.S.-based client undertaking a $100 million fundraise, I developed a fully customized global investor database designed to align high-quality capital sources with institutional-grade real estate opportunities in the United States. The database consolidates more than 14,000 qualified institutional and private investors across multiple asset classes and geographies, providing a tiered framework for capital engagement. This proprietary structure identifies direct key contacts across pension funds, insurance companies, endowments, family offices, and sovereign entities, ensuring precision targeting and controlled investor access within each segment.

Regional and Segment Diversification

The targeting matrix spans North America, the Middle East, Europe, and Asia, encompassing both institutional and private wealth channels. Within the U.S. and Canada, over 1,000 real estate funds and 3,000 family offices were mapped to highlight consistent-yield investors seeking exposure to U.S. income-producing assets. The GCC region, with its strong appetite for cross-border diversification, includes 311 key decision-makers and 325 family offices identified for strategic introductions emphasizing the “Gateway to U.S. Institutional Real Estate” theme. Complementing this, European and Asian family offices, as well as insurance companies and asset managers, were profiled for long-term, dollar-denominated allocations focused on capital preservation and income stability.

Strategic Messaging and Fund Alignment

Each investor contact will be approached with a tailored core message designed to reflect their investment mandate and geographic priorities. Institutional groups such as pension funds, endowments, and insurance companies receive positioning centered on “Reliable Yield and Stable U.S. Exposure,” while private and family office segments were targeted with value propositions emphasizing “Stable Property-Backed Returns” and “Inflation-Hedged U.S. Income Streams.” The strategy was designed not only to broaden the capital base but to match investors with the fund’s core themes of consistent performance, downside protection, and strategic access to prime U.S. real estate income assets.

Note: This Database was part of a Retainer Based Fundraising Assignment in 2025. Custom Lists and Prices available upon request.

See this database below.

🏛 Institutional-Grade Investor Intelligence

Built for fund managers, developers, and advisors – DubaiInvestorsList.com offers verified, professionally structured databases covering:

- Middle East Family Investment Offices (UAE, Saudi, GCC)

- Global Family Offices – across North America, Europe, and Asia

- USA Family Office Database

- Private Equity, Venture Capital & Fund Databases

- Institutional Real Estate & Infrastructure Investors

- Pension Funds, Endowments, and Sovereign Wealth Funds

Each dataset is updated for 2024–2025 and provides verified contacts, direct emails, and institutional ownership details – designed to streamline fundraising, investor targeting, and deal sourcing.

🗂️ Format: Excel (.xlsx)

📦 Delivery: Manually sent within 24 hours after payment

💳 Payment Options: PayPal or Credit Card

Are you seeking to engage senior business decision-makers in Dubai in 2026?

This exclusive Dubai Business Owners and C-Suite Executives Database provides direct access to more than 65,000 verified founders, business owners, and senior executives across the UAE. Curated specifically for professional outreach, the database includes experienced decision-makers who control operating businesses, evaluate private opportunities, and regularly engage in strategic partnerships and small-ticket private investments. Built from extensive proprietary research and continuously updated through January 2026, it offers a level of accuracy, seniority, and regional depth that is rarely available outside specialist corporate intelligence platforms.

JUST RELEASED – VENTURE CAPITAL DATABASE

💰 Who’s Funding Early-Stage Startups?

The U.S. venture landscape is undergoing a powerful resurgence – driven by a wave of early-stage funds fueling innovation across technology, healthcare, finance, and real assets.

I recently reviewed 500 U.S. venture capital funds targeting early-stage startups (drawn from my database of 4,000 VC funds), all launched between 2022 and 2025, as part of a broader analysis of global venture capital activity. Here are my key findings:

From micro funds under $20M to institutional co-investment vehicles exceeding $1B, the U.S. continues to dominate early-stage fundraising activity, setting the pace for global venture innovation.

🌍 Key Investment Trends

- Early-Stage Acceleration

Roughly 70% of new funds focus on pre-seed to Series A rounds – underscoring investor appetite for high-growth, early-exit potential. - Sector Diversification

Core activity spans Information Technology, Life Sciences, FinTech, and Real Estate Tech, reflecting the convergence of digital and tangible assets. - Regional Momentum

Beyond Silicon Valley, hubs like Austin, Miami, Boston, and New York are seeing rapid fund formation, attracting family offices and institutional LPs. - Data-Driven Deployment

Institutional investors increasingly rely on verified fund data, co-investment analytics, and precision sourcing tools to identify scalable opportunities and strategic alignments.

JUST RELEASED – AI INVESTORS DATABASE

VCs & Investors Raising Capital for A.I. Startups.

🤖 Who’s Funding the Artificial Intelligence (AI) Boom?

The global venture ecosystem is undergoing its biggest transformation in decades – driven by the explosive rise of Artificial Intelligence (AI).

Between 2022 and 2025, over 200 new venture and private funds have launched with AI as a primary focus, signaling that investors now view AI as the defining technology of the next decade.

Across North America, Europe, Asia, and the Middle East, capital formation spans every stage – from micro seed funds under $10M to billion-dollar expansion vehicles fueling automation, data analytics, and machine learning infrastructure.

💡 Key Investment Trends

1. Seed-Stage Dominance

Nearly two-thirds of AI-focused funds target pre-seed to early-stage rounds, backing core technologies, developer tools, and data platforms at inception.

2. Multi-Sector “AI-Plus” Funds

Investors are increasingly merging AI with other verticals – AI + healthtech, AI + fintech, and AI + climate tech – positioning AI as a cross-industry growth engine.

3. Regional Acceleration

- Europe leads with ~40% of new fund launches, emphasizing deep-tech and ethical AI.

- North America continues to dominate in fund size, backing data-driven enterprise AI platforms.

- Asia is scaling fast through industrial AI, robotics, and government-backed innovation vehicles.

4. Institutionalization of Growth Capital

A growing share of Series A–B funds signals the maturing commercialization of AI, with tickets ranging from $50M–$150M for scalable platforms and proven models.

Why This AI Investor Database Is the Most Comprehensive Source for Raising Capital in the Sector

Built from verified fund filings and institutional disclosures, this database delivers exclusive, investment-grade intelligence unavailable through public channels or scraped sources.

Each profile has been verified to confirm active AI mandates, live capital deployment, and portfolio engagement via a Institutional Grade Database – ensuring users access only genuine, investing entities.

To replicate this database would require weeks – possibly months – of research or tens of thousands of dollars across multiple institutional databases – making it a truly unique and unmatched resource for professionals raising capital in artificial intelligence and emerging technology.

SPECIALTY INVESTOR DATABASES

Middle East Family Investment Office Database – 430 Firms & 1,027 Key Contacts & 497 Email Contacts – US$395

Description: An exclusive Database of Middle East Family Investment Offices with Key Contacts. Updated in 2025. The Middle East Family Investment Office (FIO) Database represents the most comprehensive and verified intelligence platform across the GCC and broader MENA region. Built exclusively for fund managers, developers, and advisors seeking direct access to private family capital, it maps the region’s most influential wealth groups actively investing across private equity, venture capital, real estate, infrastructure, and private credit.

PREMIUM DATABASE – JUST LISTED IN OCTOBER 2025

UAE Family Investment Office Database – 195 Firms & 430 Key Contacts & 200 Email Contacts – US$295

Description: An exclusive Database of UAE Family Investment Offices with Key Contacts. Updated in 2025. The Exclusive 2025 Middle East Family Investment Office Database provides the essential intelligence for streamlining capital access and accelerating deal flow within the GCC and MENA regions. This database identifies institutional firms capable of high-value investment and is perfect for fundraises in the $5 Million to $50 Million range (and beyond), allowing you to target opportunities that match your precise strategy and geographic focus.

PREMIUM DATABASE – JUST LISTED IN OCTOBER 2025

Saudi Arabia Family Investment Office Database –

100 Firms & 280 Email Contacts – US$295

Description: An exclusive Database of Saudi Arabia Family Investment Offices with Key Contacts. Updated in 2025. The database identifies Single and Multi-Family Offices across Riyadh, Jeddah, Dammam, and Al Khobar – each verified for active global investment mandates in private equity, venture capital, real estate, infrastructure, and private credit.

PREMIUM DATABASE – JUST LISTED IN OCTOBER 2025

Institutional Real Estate Investors Database (Global) –

13,680 Firms / Companies & 31,500 Email Contacts – US$1,295

Description: An exclusive Database of Global Institutional Real Estate Investors with Key Contacts. Updated in 2025. The dataset spans sovereign wealth funds, pension funds, insurance companies, banks, wealth managers, fund-of-funds managers, endowments, superannuation schemes, family offices, and investment trusts, among many others – each verified as active participants in real estate and infrastructure markets.

Family Investment Offices (Global) Updated October 2025 –

3,700 Firms & 11,400 Key Contacts – 6,230 Emails – US$695

Description: An exclusive Database of Family Investment Offices with Key Contacts. Updated in 2025. This exclusive database provides verified intelligence on the world’s leading Family Investment Offices (FIOs) — the private capital networks of ultra-high-net-worth families, business dynasties, and family-owned conglomerates. Representing more than $3.5 trillion in aggregated global assets, this 2024–2025 edition offers direct insight into family offices actively allocating to private equity, real estate, venture capital, private credit, and infrastructure worldwide.

USA Seed Capital & Angel Group Database

500 Key Firms – Updated in 2025

Description: An exclusive Database of USA Seed Venture Capital & Angel Group Firms. Updated in 2025. The USA Seed Venture Capital & Angel Group Database delivers verified intelligence on 500+ early-stage investment firms and angel groups across the United States. It provides direct access to America’s most active seed-stage investors, accelerators, and syndicates deploying capital into high-growth startups across technology, consumer, healthcare, and fintech sectors.

Note: All Databases will be emailed after purchase. Typical time of delivery is between a few minutes and up to 4 hours. No refunds on Database Sales. The Links above will direct you to the Payment window where you can use either PayPal or Credit Card. For more information watch the YouTube Video below.

320+ Verified Client Endorsements

REAL REVIEWS | REAL PEOPLE |

REAL FEEDBACK

FROM VERIFIED CLIENTS!

Unlike many platforms that rely on fabricated or unverifiable testimonials, every review shown below comes from a confirmed purchaser of my databases or related fundraising services. These are authentic client experiences, provided by professionals who have used my databases and strategies in real capital-raising environments.

TO PURCHASE ANY OF THESE DATABASES REACH OUT VIA THE CONTACT FORM.

Important Disclaimer:

The owners of this website reserve the right to modify previously published pricing at any time without prior notice. Additionally, they reserve the right to decline the sale of any database if there is reason to believe the purchaser may engage in spam, misuse, or any activity deemed unethical or in violation of applicable laws or terms of use. No refunds on database sales.