🤖 AI Investor Database (2025 Edition)

Gain verified access to the world’s most comprehensive database of institutional, venture, and private investors actively funding Artificial Intelligence and emerging technology ventures.

This exclusive dataset features 2,400 verified investor groups, fully updated for 2025, representing the most complete global coverage of AI-focused capital sources available.

🌍 What’s Inside

Each profile is sourced from verified venture commitments, and institutional filings – providing actionable, investment-grade intelligence for professionals raising capital in AI, machine learning, automation, robotics, and data-driven technologies.

Investor Types Covered:

- Venture Capital Firms

- Private Equity Firms

- Corporate Venture Arms

- Sovereign Wealth Funds

- Family Investment Offices

- Investment Holdings & Conglomerates

- Government Innovation Funds

Unlike generic directories, this dataset isolates active AI allocators – investors with confirmed exposure to AI, automation, and deep tech portfolios.

Every contact is verified for sector activity, deal participation, and geographic relevance.

💼 Why It Matters

Artificial Intelligence has become the fastest-growing investment theme globally – spanning infrastructure, software, robotics, data analytics, and automation.

This database provides a direct gateway to the investors deploying equity into AI startups, funds, and strategic ventures worldwide.

Ideal for:

- Founders & Startups Seeking AI-Focused Funding

- Fund Managers & Technology Advisors

- Corporate Development Teams

- Private Equity and Venture Analysts

📊 Database Details

- 560 Verified Active Funds

- 1,850 Private Equity Investment Groups

- 38 Venture Capital Firms

- 9,700 Key Contacts

- 9,380 Verified Emails

- Global Coverage: North America, Europe, Middle East, Asia-Pacific

- Structured by: Investor Type, Stage Focus, and AI Investment Mandate

- Format: Excel (.xlsx)

- Delivery: Manual dispatch within 24 hours of payment

- Payment Options: PayPal or Credit Card – No refunds on database sales

View the Video Description Below

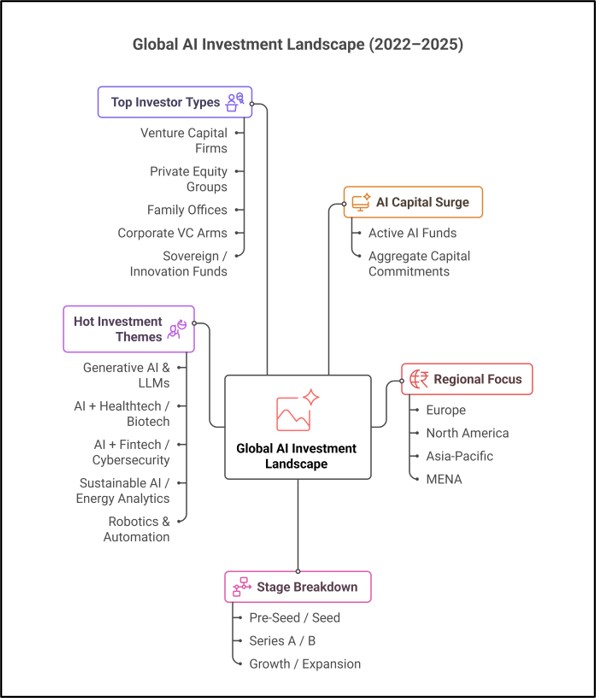

🌍 Global Surge in AI Venture Capital: Mapping the New Investment Landscape (2022–2025)

After reviewing my proprietary AI Investor Database, I’ve outlined several key observations on where institutional and private capital is currently flowing within the AI sector.

The global venture capital ecosystem is in the midst of an unprecedented pivot toward artificial intelligence (AI). Between 2022 and 2025, over 200 newly launched funds have included AI as a primary or secondary focus – a sign that investors now view AI as the defining technology of the next decade.

Across Europe, North America, Asia, and emerging innovation hubs in the Middle East, new funds are being raised at all stages – from micro seed vehicles under $10 million to multi-billion-dollar expansion funds. Together, they represent one of the fastest-growing segments in global VC formation.

🧠 The Dominance of Early-Stage AI Capital

Approximately 60–65% of all newly launched AI-focused funds between 2022 and 2024 are pre-seed, seed, or early-stage vehicles. This concentration underscores a strong investor appetite for foundational technologies and early market entry points.

- Examples:

- Indico VC Fund II (Portugal/Spain) – early-stage AI and SaaS startups targeting global leadership.

- Infodriver Capital (London) – focuses on DeFi, GameFi, and AI startups across the UK, UAE, and US.

- Innovobot Fund I (Canada) – seed-stage AI, IoT, and robotics companies.

- Inventure IV (Nordics) – deep tech with AI and VR emphasis.

- KK Fund III (SE Asia) – early-stage AI, blockchain, and mobility plays.

Most of these funds position themselves as first institutional backers, targeting pre-seed and seed rounds under $3 million. By entering early, they capture the exponential upside as AI adoption accelerates across software, healthcare, and industrial automation.

💡 The Rise of Multi-Sector “AI-Plus” Funds

Another clear trend is the emergence of multi-vertical funds – vehicles that invest in AI + healthtech, AI + fintech, or AI + clean tech combinations.

- Examples:

- La Famiglia Fonds III (Germany) – AI, ML, and logistics.

- LongeVC Fund II (Europe) – AI in pharmaceuticals and biotech.

- LRV V (US) – AI and machine learning in healthcare.

- Life Science Fund No. 2 (Flagship Pioneering + Samsung C&T) – AI-driven biotech platforms.

- KSP Next Generation Fund (Japan) – AI, robotics, nanotech, and quantum computing.

This multi-sector blending shows that AI is no longer treated as a standalone theme – but as a horizontal enabler driving efficiency, predictive capabilities, and automation across industries.

🌏 Regional Investment Trends

Europe remains one of the most active AI fund formation zones, accounting for roughly 40% of all AI fund launches in this dataset.

- Funds like Lakestar Early IV, Look AI Ventures, and Kairos Ventures ESG One are leading the charge with early- to mid-stage vehicles ranging from €20 million to €280 million.

North America continues to lead in capital size, especially at growth stages:

- Databricks Ventures’ Lakehouse Fund and Inspiration Ventures IV show a preference for scalable data and analytics infrastructure using AI.

Asia, meanwhile, is experiencing a deep-tech surge – driven by national strategies emphasizing industrial AI and smart manufacturing.

- Lanchi SME Development Fund, JIC Venture Growth Fund II, and China Everbright’s Intelligent Manufacturing Fund represent multi-hundred-million-dollar commitments into industrial automation and applied AI.

📈 Shift Toward Series A–B Institutionalization

While early-stage funds dominate in number, there’s a rising share (around 25–30%) of Series A–B and growth-stage AI funds, signaling maturing deal flow.

Funds like Kembara (Mundi Ventures), Kairos Partners’ ESG One, and Invivo Ventures III are allocating tickets from $50–$150 million, seeking proven revenue traction and defensible data moats.

This evolution indicates a gradual institutionalization of AI venture capital, where deep learning and generative AI models are being valued not just for innovation, but for scalability and commercialization.

🚀 The Strategic Importance of Seed Dominance

Seed and pre-seed funds (roughly two-thirds of the total) are driving ecosystem creation — backing infrastructure, developer tools, and industry-specific AI applications.

In regions like Europe and Asia, seed AI funds play a national policy role:

- Spain’s Bullnet Capital IV co-invests with the government’s CDTI vehicle.

- Japan’s KSP Fund collaborates with KISTEC for deep-tech assessments.

- The UAE and Singapore ecosystems are beginning to mirror this state-private partnership model.

🧩 What This Means for AI Founders

For founders, this surge creates a window of opportunity — but also growing competition. With hundreds of funds targeting early-stage AI startups, differentiation through proprietary data, applied domain focus, and monetizable models will be critical.

Investors, meanwhile, are signaling a clear long-term thesis:

AI is no longer speculative – it’s infrastructure.

And the global investment cycle is still in its first innings.

🧮 Global AI VC Snapshot (2022–2025)

| Stage | % of Funds | Example Funds | Avg. Fund Size (USD) |

| Pre-Seed / Seed | 45–50 % | Indico VC Fund II, KK Fund III, Kobol I | $20 M – $80 M |

| Series A / Early | 20–25 % | Inventure IV, Innovobot Fund I, Infodriver Capital | $80 M – $150 M |

| Series B / Growth | 15 % | Kairos ESG One, Invivo Ventures III, Kembara | $150 M – $1 B + |

| Expansion / Late | 10–15 % | JIC Venture Growth Fund II, China Everbright Fund | $500 M – $1.4 B + |

💬 Closing Insight

From micro seed funds in Lisbon to billion-dollar expansion vehicles in Tokyo, AI venture capital has become truly global.

The sector’s rapid evolution – marked by deep specialization, government co-funding, and cross-border collaboration – suggests that AI will dominate private capital formation through 2030.

What we’re witnessing isn’t a wave – it’s the foundation of a new capital paradigm centered on intelligent, data-driven innovation.

📅 October 2025 – ✍️ Written by Andrew Thomas – The Investors Link

🔗 See my exclusive AI Investor Database above if you are raising capital in the AI sector.

AI Investment Momentum: Recent Funding Rounds and M&A Deals Driving the Next Wave of Innovation (October 2025)

Top Artificial Intelligence Deals, Investors & Market Trends

📅 October 2025 – ✍️ Written by Andrew Thomas – The Investors Link

The U.S. Artificial Intelligence sector continues to attract significant investor attention across enterprise SaaS, healthcare, security, automation, and applied AI verticals. From early-stage venture rounds to corporate M&A and growth capital transactions, deal flow remains resilient – demonstrating continued conviction from private equity and venture capital investors despite broader market volatility.

Below is a overview of notable AI transactions from October 2025, organized by stage, with details on the companies, investors, and themes driving capital deployment.

📌 PE Growth & Expansion

| Company | Description | Investor(s) | Notes |

| Machinify | AI-powered healthcare payment integrity platform | Town Hall Ventures | Growth capital for expansion with U.S. payers |

| Syntheia | Proprietary generative AI algorithms | Undisclosed | CAD 2.41M development capital |

| EdSights | AI student-engagement & retention via conversational tools | JMI Equity | $80M development capital |

| Scryb | Applied intelligence & real-time analytics platform | Undisclosed | CAD 1.47M development capital |

| Ivani | Human-presence AI sensors | Soryn IP Capital Mgmt. | Growth capital |

| Testsigma | AI test automation for apps | Evolvence India | Growth capital |

📌 Trend Insight: Investors remain highly focused on workflow automation and AI-enabled platforms that reduce operating costs for enterprises. Education, healthcare, and software testing saw particularly active attention.

🤝 Mergers, Acquisitions & Corporate Activity

| Company | Acquirer | Sponsors (if applicable) |

| Inky (AI threat detection) | Kaseya | Insight Partners, Sixth Street, Ares, Morgan Stanley, Blue Owl, others |

| Qualifi (AI hiring automation) | Humanly | — |

| R2Decide (AI sales assistant) | Xgen AI | Kapstone Equity Group |

| Typper (AI workflow automation) | Árvore Educação | Teman Capital |

| Alteris (AI healthcare ops automation) | Flight Health | — |

| Credora (AI credit risk) | RedStone | — |

| Firmus (AI construction design QC) | Bluebeam Software | — |

📌 Trend Insight: Strategic buyers remain aggressive, especially where AI replaces legacy systems in cybersecurity, HR, and construction data intelligence.

🚀 Later-Stage VC (Series A–C)

| Company | Sector | Round | Lead Investor(s) |

| Simple App | Digital health & weight management | Series B ($35M) | Hartbeat Ventures |

| Krista Software | AI customer experience | Venture | — |

| Atomic Industries | AI manufacturing automation | Series A-1 ($25M) | MaC VC, DTX Ventures |

| Moneta | AI cognitive therapy | Venture ($4.5M) | True Ventures, Health2047 |

| Dimension Labs | AI data infrastructure | Venture | Brickyard |

| PrimeAI | AI enterprise productivity | Venture ($1.75M) | — |

📌 Trend Insight: “AI + Industrial” and “AI + Health” are now the hottest later-stage categories as investors look for defensible IP and real-economy use cases.

🌱 Early-Stage VC (Seed & Pre-Series A)

| Company | Focus | Amount | Lead/Notable Investors |

| Peer | AI community & merchant platform | $16M | — |

| Intelo.AI | AI merchandising | $2M | Illuminate Ventures |

| Huxe | AI podcast generation | $4.6M | Conviction, Genius Ventures |

| BoltWise | AI quoting SaaS | $2.5M | — |

| CoachEm | AI sales coaching | $900K | — |

| Social Cascade | AI content for caregivers | Seed | Symphonic Capital |

📌 Trend Insight: Seed activity remains strong, especially around AI productivity and vertical SaaS.

🌱 Angel, Seed, & Accelerator Rounds

| Company | Focus | Raise |

| Litewave AI | Regulatory compliance AI | $1.25M Seed |

| AIstats | AI sports analytics | $1.1M Pre-Seed |

| Accordance | AI tax + accounting automation | $13M Seed |

| Diligent Robotics | AI healthcare robots | Accelerator |

| OutcomesAI | AI clinical care support | $10M Seed |

📌 Key Takeaways for Investors & Founders

| Trend | Observation |

| ✔ AI is shifting from hype to real workflows | Healthcare, enterprise ops, and industrial AI dominate funding |

| ✔ PE and Strategic Buyers are active | M&A appetite is strong for niche AI tools |

| ✔ Seed-level innovation remains vibrant | Founders building vertical AI SaaS still attract early capital |

| ✔ Monetization matters | Investors are prioritizing revenue-ready models over experimental AI concepts |

📌 For Founders: Who is Funding AI Right Now?

If you are raising capital, the strongest investor demand today is in:

✅ Applied Enterprise AI (productivity, workflow, data automation)

✅ AI for Healthcare & Med-Tech

✅ AI-powered Industrial & Manufacturing Systems

✅ Cybersecurity AI

✅ Vertical SaaS with recurring revenue potential

🔗 See my exclusive AI Investor Database above if you are raising capital in the AI sector.